Hello everybody,

A number of years ago, I took a tool originally created by a man named John Exter—something that has come to be known as Exter’s Pyramid—and redesigned it to reflect how I believed the financial reset would unfold.

John Exter was an American economist and central banker whose career spanned the 1950s through the 1970s. After helping establish the Central Bank of Ceylon (now Sri Lanka), he later joined the Federal Reserve Bank of New York, where he specialized in gold and silver markets. Working from within the heart of the global monetary system, Exter grew increasingly alarmed as he witnessed the steady debasement of the U.S. dollar.

This erosion occurred under the Bretton Woods system, which was meant to anchor the dollar to gold at a fixed price of $35 per ounce. Exter recognized that this peg was being maintained not through discipline, but through large-scale intervention and manipulation. The United States was issuing far more dollars than its gold reserves could credibly support.

From this imbalance, Exter concluded that Bretton Woods was doomed. He believed foreign governments would eventually realize the dollar’s convertibility was a fiction, prompting them to exchange their excess dollars for U.S. gold. Such a run, he reasoned, would force the system to collapse. Acting on this conviction, Exter converted his entire life savings into gold in 1968 and waited.

He did not have to wait long. On August 15, 1971, President Richard Nixon closed the gold window, unilaterally ending dollar convertibility and dismantling the Bretton Woods system. Gold was soon allowed to float freely, and its price surged—rising roughly twenty three times over the following decade. Exter’s foresight transformed his savings into a considerable fortune, allowing him to retire from central banking and reemerge as an independent market commentator.

In this new role, Exter devoted himself to warning the public about the inherent instability of a fiat monetary system backed by debt rather than tangible reserves. He argued that such a system inevitably leads to excessive leverage, asset bubbles, and ultimately a systemic banking crisis.

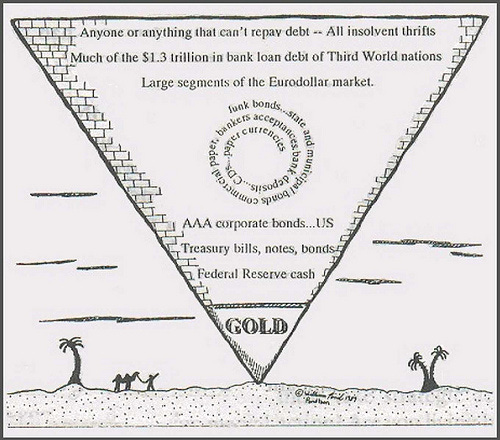

To illustrate this process, Exter developed what later became known as Exter’s Pyramid. The inverted pyramid depicts how capital behaves during a financial crisis: highly leveraged and speculative assets sit at the top, while progressively safer and more liquid assets appear lower down. In times of stress, capital cascades downward in a frantic flight to safety.

At the very base of the pyramid, Exter placed gold—alone and physically separated from the rest of the structure. He believed that in a true financial meltdown, the most valuable asset would be one with no counterparty risk, no default risk, and no dependence on the solvency of any institution. Gold, in his view, was the only asset that met these criteria.

While Exter’s original pyramid featured only gold at its foundation, my modern interpretation also includes silver due to its monetary properties. Although John Exter passed away in 2006 without witnessing the full-scale collapse he anticipated, he lived long enough to see risks multiply far beyond his original concerns. In his era, the most dangerous asset was Third World sovereign debt. Today, the apex of the pyramid is dominated by the global derivatives market—an estimated $2–4 quadrillion in notional value, representing a vast web of leveraged obligations and, ultimately, promises that cannot all be kept.

When I first discovered Exter’s Pyramid, I immediately understood its logic. However, I also realized that the next crisis and subsequent mass default would likely entail a full reset of the financial system. Which I believed would trigger a widespread rush back into real assets, as a system built on financialized and largely fictional value collapsed. This was a departure from the previously held belief that land and commodities would collapse in value during the reset. Instead, I theorized that once confidence in debt based assets collapse, capital would flee toward real value—the small pool of assets that actually underpins the system itself: land, commodities, and, above all, gold and silver.

In 2022, I shared my updated version of Exter’s Pyramid with my audience and explained that in the coming crisis, gold and silver would become the most important—and best-performing—assets in the world. At the same time, there would be an aggressive scramble to acquire land and commodities, as these represent the true foundation of all wealth, including monetary metals themselves. I knew that once these dynamics began to play out, the financial reset would be underway. For those seeking protection from what was coming, my pyramid was intended to serve as a guide—both for understanding how the default would unfold and for identifying which assets would be most vital to own.

At the time, we had not yet been introduced to The Great Taking. But because of my long-standing study of financial resets and monetary history, the moment I learned about it, it fit peerfectly into my existing framework—including my redesigned Exter’s Pyramid. The Taking is, in essence, the systematic looting of any available assets trapped within the system, because they have been put up as collateral for the top layer of the system: the $2–4 quadrillion global derivatives complex. Numbers so great that no amount of collateral will suffice, which ensures that in the crisis—it’s all taken. With the financial system now coming under severe stress, and many warning signs emerging, I felt it was the right moment to revisit the pyramid, as we are now watching the very scenario I outlined—and the internal dynamics of the pyramid itself—unfold in real time.

Gold and Silver: With silver up 210% in a single year and gold up 75%—and with gold having been the best-performing asset over the past 25 years—it is becoming increasingly clear that the base of the pyramid is proving to be the most important layer of financial protection, exactly as I expected.

Commodities and Land: At the same time, we are witnessing a global rush to acquire land and resources. This can be seen in geopolitical actions such as the United States’ move on Venezuela, driven by the desire to control its oil reserves and critical minerals, as well as the placing of Greenland and Canada firmly in the crosshairs. For those confused about why this is happening, the pyramid provides the explanation. The war is on for control of commodities and land. It is becoming increasingly obvious to me that we are watching a silent run on the system. The cabal—and the entities they control—are desperately scrambling to secure possession not just of gold and silver, but of all real assets. These are warning signs. If my pyramid was accurate, this is what we should be seeing ahead of a financial reset.

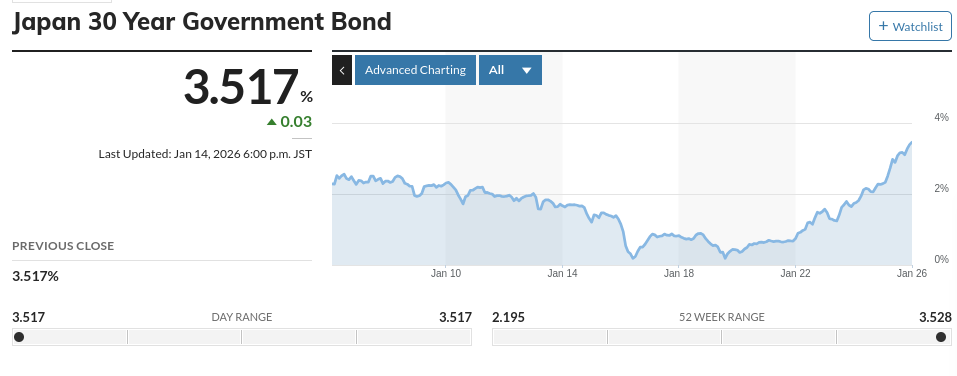

Sovereign Debt & Fiat Currencies: Above this sits the imagined and false base layer of the modern financial system: sovereign debt and fiat currency. With sovereign debt especially considered the most ‘secure’ form of collateral. This layer will be defaulted on, as will the many tiers of debt and derivatives built above it. Worryingly, sovereign debt is now beginning to lose all credibility and collapse in value, undermining the very collateral that supports the remainder of the system. The can lead to margin spirals and ultimately, the system unwinding catastrophically. One need only look at Japanese bond yields to see this process accelerating. Alongside this, we will also see a catastrophic collapse in housing, retirement accounts, and equity markets—all inflated bubbles fueled by leverage and debt.

We’re not there yet. But if we start at the base of the pyramid and move upward, we can see that every tier is now shaking violently. Time is ticking.

In my opinion, this could well be the final consolidation of real value before they enact a controlled demolition of the pyramid’s upper layers. I believe this implosion is being deliberately delayed to maintain the illusion that retirement accounts, stock portfolios, and housing values are safe—preventing the public from exiting the system and converting nominal wealth into real assets—before they make their move. There simply isn’t enough real value to go around. And as the rising prices of gold and silver demonstrate, even a small trickle of capital fleeing debt-based assets into finite, tangible stores of value is enough to force prices dramatically higher.

Watching all of these developments unfold according to the pyramid I created is both fascinating and deeply alarming. It suggests that the end of the current paradigm is close. Once real wealth has been fully absorbed—and everyday people have been priced out of owning it—there will be nothing left to prevent the deliberate implosion of what remains of the system, ensuring that the final assets are taken as well. All of this appears to be in service of what they envision as the next system to replace it. A digital, tokenized system of surveillance and control.

Fortunately, for those paying attention, there is still time to secure your wealth. My revised Exter’s pyramid remains the simplest—and yet most accurate—tool for navigating the transition out of notional value and into real assets. Enjoy the video.

Mike

SUBSCRIBERS ONLY CONSULTATION OFFER

In recent weeks I’ve received a number of inquiries regarding my availability for 1–2–1 consultations. For more than four years I’ve been guiding clients towards positioning themselves and their families to protect their wealth during the high-risk environment we are now in.

From managing the Great Taking and asset confiscation, to protecting pensions and 401(k)’s — this is where I specialize. I also support people with creating a Plan B and preparing to become more self-sufficient. Normally, I only offer a limited number of consultation slots each month, but given what is unfolding, I am opening my diary up in the coming months to focus on consultations.

As a thank-you to my subscribers for their support throughout 2025, I am offering 20% off all consultations booked before the end of January. This is the first time I have ever discounted my consultations.

As such, if you would like personal, one-to-one support to secure your wealth, now is a great time to book. The discount can be accessed via the link below.

GROUP COACHING FOR INVESTORS BEGINS FEBRUARY

I’m excited to let you know that bookings are now open for the February cohort of Group Coaching for Investors. Group coaching is your opportunity to learn the skills and knowledge required to preserve and grow your wealth going into the reset.

Because group coaching is delivered live with Mike on Zoom, the cohort is kept intentionally small to ensure everyone gets real value. For that reason, spaces are already limited.

What’s included in group coaching:

12 sessions live on zoom

Each session focuses on a key topic, including the Great Taking, protecting pensions and 401(k)s, gold and silver strategies, ratios, cycles, and more

Group discussion and Q&A after every session

Wealth preservation skills and strategies I am actively implementing to protect and grow my families wealth going into the reset

Additional workshops you can watch in your own time

Access to my monthly investor mastermind, where market risks and opportunities are discussed

For more information on group coaching, please click here. If you would like to discuss potentially joining us for group coaching or have any questions, please email parallelsystems@protonmail.com

Watch my work on YouTube

Listen to Parallel Mike Podcast on PodBean / Spotify / YouTube / ParallelMike website

SUPPORT THE SHOW

Become a Paid Subscriber to listen to my Financial Newsletters and join our supportive community

Join Parallel Mike Podcast to enjoy full length podcast episodes

Meet Mike for 1-2-1 Consultation to discuss how to preserve your wealth and prepare for challenges ahead

Help me spread this important message…press ♥️ and restack to alert others.