Hi everyone,

We’re back with the latest installment of the audio newsletter—but this edition, I have something a little bit different to share with you.

I'm sharing a recent recording from my private Investor Mastermind session, a monthly call I host with people I work with either 1-2-1 or through my group coaching for investors. These monthly calls are where we discuss at length current market events, preserving wealth, risks, and where the opportunities might lay.

This month’s call focused on a critical and timely topic: the unfolding crisis in Sovereign Debt and its connection to The Great Taking. It was a great discussion, and we explored a lot of specifics of what has happened over the past month.

At the end of the call, I realized this was a conversation worth sharing more broadly—so I asked the participants if they’d be happy with me sharing the recording with you all.

As a paid member, you’ll unlock weekly articles on wealth preservation and finance, my exclusive financial newsletter (released roughly twice a month), full access to the entire archive, and the ability to join the conversation with commenting privileges on every post. Your support makes this work possible — and gives you direct access to the insights, analysis, and community that matter now more than ever.

The failure of large nations to sell sovereign debt is definitely a huge risk and one we need to keep our eyes on. Right now, it feels like we're heading straight into a major financial crisis. As I discussed in my most recent article, the unrealized losses behind the scenes, will be staggering.

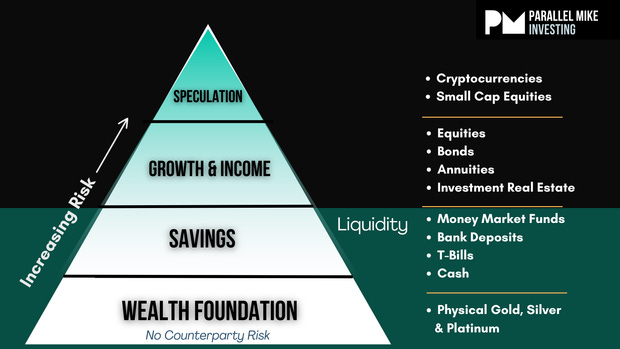

In terms of what you can do to prepare, now is a great time to revisit the Wealth Preservation Pyramid. Ask yourself:

Where are you currently allocated?

How much exposure do you have to the banking system and to counterparty risk?

How liquid are you financially?

Do you have a few months’ worth of cash available for emergencies?

Are your deposits spread across multiple banks, just in case one or multiple banks face liquidity issues?

Do you have essentials at home to survive a period of hardship?

As always, please leave your comments or questions below—I love reading them, and I’ll aim to answer as many as possible in the next newsletter.

Take care,

Mike

Sovereign Bond-aggedon Has Begun

For nearly 80 years, the world has operated within a geopolitical and financial system born from the devastation of World War II. What emerged—often referred to as the rules-based international order—rested on three core pillars: