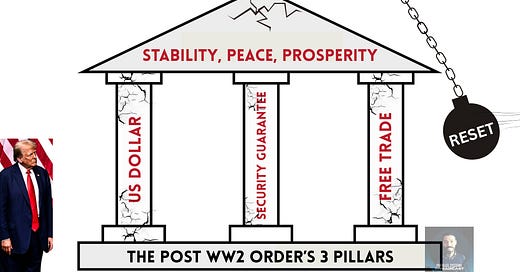

For nearly 80 years, the world has operated within a geopolitical and financial system born from the devastation of World War II. What emerged—often referred to as the rules-based international order—rested on three core pillars:

The US dollar (specifically US Treasuries) as the global reserve asset.

The US military as the de facto guarantor of global security and freedom of navigation.

Globalization—the frictionless flow of goods, capital, and information, enabled by the first two.

Together, these pillars formed the architecture of a system so vast and so deeply embedded, that for many it was seen as indomitable. A forever system that could never be unwound or reversed. But that illusion is now over.

In 2025, we are no longer spectators to a slow decline of the old world order—we’re watching it get dismantled, in real time. Consider the financial signals flashing red in the past few weeks alone. We saw one of the weakest US 20-year Treasury auctions in history. In the worlds second largest sovereign debt market over in Japan, we witnessed 30- and 40-year government bonds yields surge to record highs, prompting Prime Minister Kishida to publicly compare the situation to Greece’s fiscal collapse.

Surprisingly, his comments didn't reassure investors all that much! Hence why demand at an auction of 40-year Japanese government bonds on Wednesday fell to the lowest level since last July. Meanwhile in the UK, long dated bonds have now surged above levels that triggered the 'LDI Crisis' which almost brought down UK pension funds back in 2022.

As a paid member, you’ll unlock weekly articles on wealth preservation and finance, my exclusive financial newsletter (released roughly twice a month), full access to the entire archive, and the ability to join the conversation with commenting privileges on every post. Your support makes this work possible — and gives you direct access to the insights, analysis, and community that matter now more than ever.

Then, earlier this week, the IMF announced that the UK government debt market is at serious risk of sharp price swings and sudden sell offs. The same dynamics are playing out in the Eurozone. This, my friends, is what they call a sovereign debt crisis.

Put plainly: there are simply too many IOUs and not enough willing participants left to absorb them. Demand for so-called safe haven sovereign debt is collapsing. And clearly this is not just a vote of no confidence in one single country—it’s a rejection of the debt based financial paradigm moreover.

Of course, beyond just the lack of demand we're seeing for new issues of debt, we’re also seeing investors dump existing holdings of sovereign debt en masse. Worse still, they’re not only dumping bonds—they're also dumping the currencies the bonds are being sold into! This is why we’re witnessing both US bond prices collapse and the dollar fall at the same time: the opposite of what typically would occur during moments of financial panic.

This is an entirely new phenomenon, and it reveals just how little trust remains in the debt-dollar system. But as I said, the problem is endemic. The consequences of collapsing bond prices will be enormous, so expect things are likely to accelerate from here on out.

In fact, just this week, the FDIC quietly revealed in its Q1 2025 report that the collapse in bond prices has triggered massive unrealized losses across the banking system—among commercial banks, insurance companies, and pension funds, all of which hold trillions of dollars in government debt.