How To Protect Yourself From the Great Taking & The Coming Financial Reset

Part 3 In My Series on the Great Taking Is All About Protecting Your Wealth

This article is the third part in a series titled the Great Taking revisited. Parts one and two can be found below:

Part One: The Great Taking Revisited: The Book That Shouldn’t Have Existed

Part Two: David Rogers Webb Latest Update

Introduction: Attempting The Impossible

The biggest criticism of David’s book, The Great Taking, was that it offered no solutions. While it lays out the problem with expert precision—thoroughly unsettling the reader in the process—it never reached the natural next step: “And here is what you can do about it.” For many, that omission was a bitter pill to swallow. They wanted a step-by-step guide on how to protect themselves and their families from the coming flood. But no life jacket was provided.

Having become friends with David over the past three years, I understand that the absence of proposed solutions was neither an oversight nor an attempt to simply blackpill the reader. Rather, it reflects his sincere belief that something this vast and this evil cannot be fully defended against. Even if one manages to escape the first wave of confiscation and the Great Taking itself, it will be followed up with others—each designed to ensnare those who evaded the last. This is not hypothetical. History offers countless examples in which, after the majority has been impoverished, the remaining pockets of wealth are inevitably targeted.

The most egregious expropriation of wealth rarely appears at the outset of a crisis. It emerges at the end—after society has already been broken and reset. In Communist Russia, the revolution and the murder of the Romanov dynasty came first. Economic collapse followed, then years of scarcity and impoverishment. Only once the masses were fully crushed, having already lost most of what they owned, were the remaining productive classes targeted. A population rendered desperate was easily mobilised to justify the seizure of land, businesses, and assets.

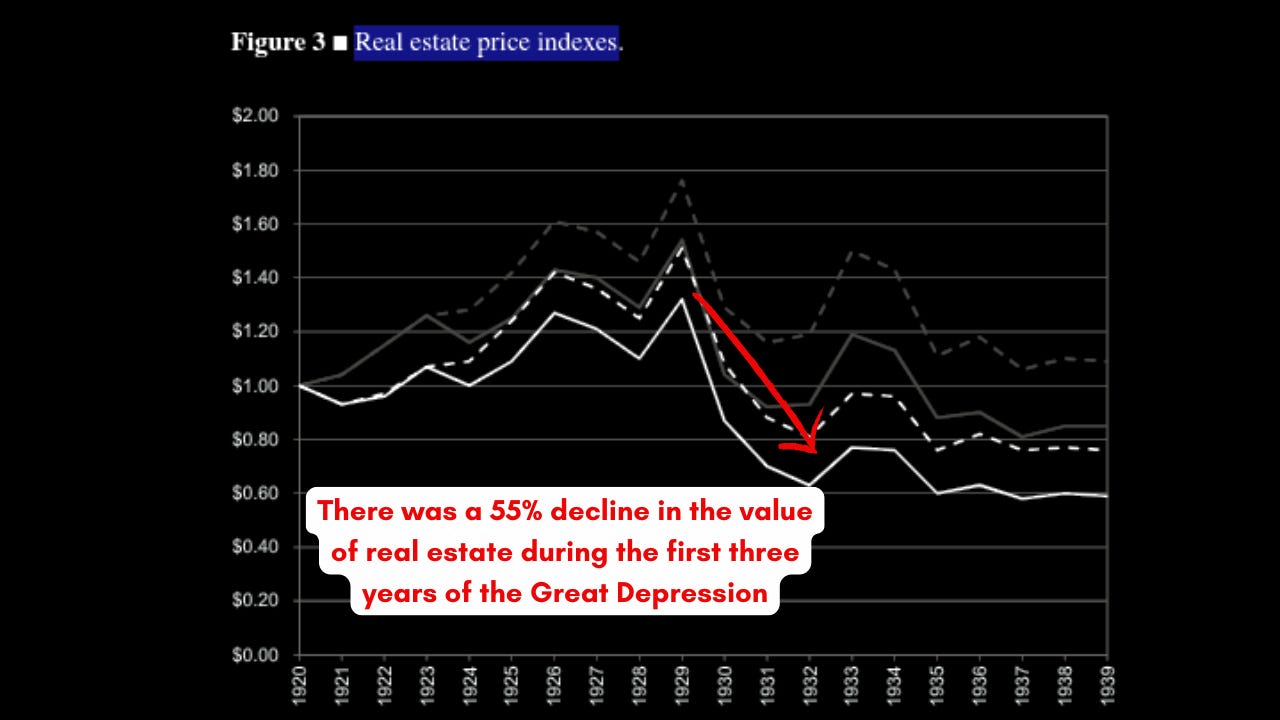

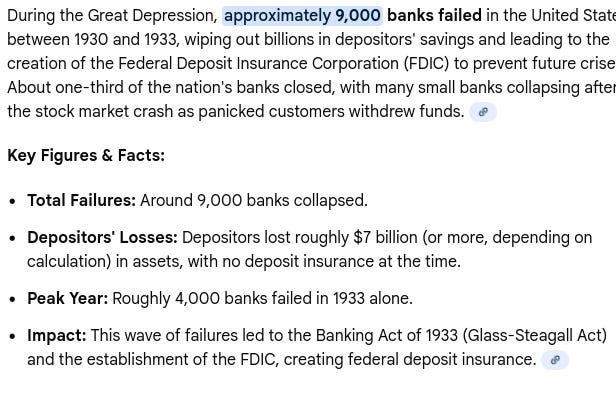

A similar pattern unfolded during the Great Depression. It began with the stock market collapse, which triggered a cascading credit contraction and the failure of banks across the country. Depositors saw their savings wiped out as institutions closed their doors. With the banking system in chaos, credit froze, collateral values collapsed, and industrial activity ground to a halt. Millions were thrown out of work. Mortgages fell into delinquency en-masse and many citizens wound up losing their family farms to the big banks.

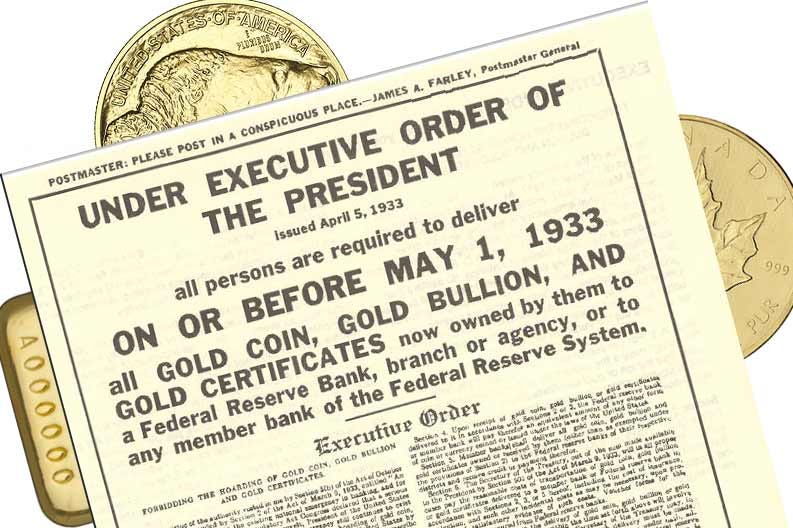

With no access to refinancing, even solvent families were losing their properties. For those who managed to survive, physical gold coins held outside the banking system, appeared to be the natural place to store what remained of their wealth. Or so they thought. Once again, after society had been sufficiently weakened, the state moved against the survivors. The gold holders. Those who believed they had escaped the asset seizure were quickly brought back to reality.

If you want to understand what happens during a systemic unwind, this is the blueprint. First, the credit system fails. Next, assets are liquidated or seized through refinancing failure—or through mechanisms like the Great Taking. Finally, whatever wealth remains outside the system is targeted and pulled back in. With asset tokenization and digital IDs on the near horizon, it is not difficult to imagine that physical and unregistered wealth—sitting beyond institutional control—could be targeted in the near future.

These mass looting events are never straightforward. The narratives are layered, distorted, and deliberately opaque, ensuring that most people neither see what is coming nor understand what is happening until it is far too late. Some may even participate in the confiscation of other citizens’ wealth, genuinely believing they are advancing a form of social justice.

With so many young people ideologically captured—and simultaneously locked out of housing, without any realistic path to prosperity—is it really unthinkable that a portion of them could be radicalized into supporting, or even participating in, the expropriation of property from so-called “selfish boomers”? When surveyed, over 50% of young people in America—the most free nation on earth, with the strongest property rights ever established—already support wealth redistribution! It is not absurd to imagine that a small fraction of them could be pushed toward violent action if it were sanctioned, justified, or encouraged by the state.

For all these reasons, any serious discussion about protection from something like the Great Taking is inherently complex. It must go far beyond simplistic advice such as “just buy gold.” The real threat is not isolated confiscation, but a full-spectrum breakdown: counterparty failures, collapsing collateral chains, evaporating liquidity, and the shutdown of the very channels through which assets are normally transferred or sold—followed by societal implosion and a rising tide of anger, fear, and despair.

In such an environment, survival is not about beating the system—it is about not being swallowed by it. The Great Depression shows us that when the collapse reaches its bottom, they come not only for the vulnerable, but for the last remaining stores of independent wealth. David, as a lifelong student of the Great Depression, understood this well. He knew that any attempt to lay out a solution in his book would be a) woefully inadequate b) give people a false sense of security and c) reduce the likelihood they would feel compelled to push back against the Great Taking in more meaningful ways.

My point is, the idea there is a perfect, simple solution to this kind of risk must be dispelled. There is no single hedge against systemic collapse, only a maze of vulnerabilities and risks to try and deal with. Protecting your family against the Great Taking requires a fundamental shift in both mindset and lifestyle. That’s why I’m writing this from a homestead, where my family and I take responsibility for our own food, water, and energy, as much as possible. I am surrounded by other farms, each with its own fresh water supply, off-grid heating, and food production. It’s no coincidence that David Rogers Webb has chosen a similar way of life, as did Matt Smith @ Crisis Investing and Doug Casey, two of the other early voices who helped raise awareness of the Great Taking.

Put simply, those of us who truly understand the risks before us—and what is likely to follow when the financial system finally unravels—are taking serious preventative steps. We recognize that living in dense urban environments while remaining dependent on centralized systems is a terrible idea. We know we need to be out of the cities and at least semi-self-sufficient. The fact that each of us made significant sacrifices to prepare for that future should be instructive in itself. The truth is, we don’t know how bad it could get. But history is very clear on one point: when debt bubbles burst and old systems die—and that is precisely where we are in the cycle—things become chaotic very, very quickly.

A Hard Truth Up Front

If this all sounds like too much effort—and you were hoping for a simple, easy-to-implement answer to the question “How do I prepare for the Great Taking?”—then unfortunately, you’re going to leave this article disappointed.

Real solutions to substantial and complex problems are never easy. They demand:

Time

Effort

Sacrifice

And, in many cases, genuinely radical decisions

There are no shortcuts here. When it comes to the Great Taking, no amount of clever portfolio restructuring will work if you have not first secured your most basic requirements for survival. History is unequivocal on this point. People endure hard times by minimizing their dependence on centralized systems. That means developing:

Practical real-world skills

Self-sufficiency capabilities

The ability to function when supply chains break and institutions fail

Believing you can protect your wealth while being unable to feed yourself without a supermarket is dangerously naive. And that naivety is precisely what the system relies on. Always remember—those who would like to see you property-less and dependent are always thinking several moves ahead. You need to think several moves ahead +1.

What you’re about to read are, of course, only my opinions—but I hold them firmly. There are no shortcuts to achieving a meaningful level of protection, so I won’t pull any punches. If I’m going to attempt the impossible—by addressing something even David chose not to tackle directly in his book—I will do so honestly.

We are living through an exceptionally dangerous period in history. Navigating it successfully requires both a realistic understanding of the risks before us and right intention: the desire and courage to act decisively, even when certainty is impossible. Without this, my article will be of little use. But for those prepared to take action, there is an opportunity not just to survive the hard times ahead, but to thrive during them. That is my goal—and I invite you to join me on this journey.

What This Framework Can—and Can’t—Do

For those willing to face this reality head-on—who want genuine resilience and meaningful insulation from what’s coming—read on.

Whether the catalyst is the Great Taking itself, or the inevitable collapse of the everything bubble, the framework I’m about to share offers the strongest protection realistically available to us

Just please be aware, it is:

Not comprehensive — I have focused only on the most important areas.

Not a panacea — Individual situations vary greatly, and strategies should be tailored to each person’s specific circumstances. Always consider your own needs and do your due diligence before acting.

Nothing discussed in this article should be taken as financial or legal advice.

So, with that said, let’s get to it.

Let’s Begin By Exiting The Casino

I was recently in a Wealth Preservation Consultation discussing the Great Taking with a client, and I used the following analogy: the global financial system is like a massive, decadent casino. You go inside, and everything looks and feels opulent and secure. You’re made to feel at home, with the hope that you forget you’re in a casino at all. So you stay, and never cash out.

Most of what you consider to be your “wealth”—stocks, bonds, retirement accounts, digital assets—are actually just chips you’re told possess real value. They feel real, and for a while, it seems like you own some of them. But the reality is, those chips are an illusion. The real wealth sits in the cashier’s booth, controlled entirely by the house.

Obviously the owners of the casino are well aware that it’s about to go bust—and if this happens, the rules suddenly change—and you lose it all. The chips in your hand transform from claims to real value, to nothing but redundant plastic tokens. They are worthless if you haven’t converted them into something real before the collapse. Meanwhile, all of the actual wealth that was stored in the cashiers booth disappears in an instant, taken by the casino’s owners.

Oh, and as you’re leaving, they decide to take your wallet — and the watch on your wrist too — because everything in the casino belongs to the casino. It’s only at that moment you realize the whole place was a scam, run by the mafia all along. But it’s too late. You walk out with nothing. This is a very apt comparison for the financial system. That’s not to say the casino can’t be profitable while the doors are still open — but you must recognize that it is a casino. And to survive its inevitable bankruptcy, you have to be willing to step outside its cozy confines.

Building Your Citadel

When you realize the aforementioned, action becomes unavoidable. This is where my Citadel Strategy comes in. A citadel is more than a fortress—it is the last stronghold, the final bastion of security when everything else has fallen. Historically, it was the heart of a city’s defences, built to protect people and vital resources through prolonged siege. In the context of the Great Taking, the Citadel Strategy serves the same purpose.

It is a deliberately layered set of defences — mental, physical, financial, and social — designed to protect you and your family, so that even a sustained attempt to seize your wealth or push you into dependency is unlikely to succeed. If the outer layers fail or turn hostile, the next layer rises, and the next, each adding complexity and resilience, ensuring that the inner stronghold—completely self-sustaining and independent of the other layers—remains untouched.

The idea is to build multiple layers of protection, insulation and redundancies into your life, both financial and otherwise, to ensure you and your family are able to survive the most challenging of circumstances. It’s your roadmap for walking out of the casino, and into a more meaningful, and prosperous future, before the house comes to take it all. It’s about converting your casino chips into real, tangible assets you hold in your own possession. It’s about building a life where you don’t need the casino to survive, and instead, you’re surrounded by loved ones, community and real wealth. Then having the strategies and mindset to hold onto it. This is how I personally am preparing for the hard times ahead, including the Great Taking. For what it’s worth, I walk the walk, and everything I describe below—is what me and my family are already doing.

The strategy is built around 5 rings of defence.

Ring 0: The Inner Keep – The Sovereign Mindset – Cultivate radical personal responsibility and mental resilience; recognize that debt is a primary tool of control and commit to breaking its shackles.

Ring 1: The Physical Bastion – The Unassailable Homestead – Build a debt-free, off-grid homestead surrounded by productive assets that provide food, energy, water, and income. This will give you complete independence from the system.

Ring 2: The Treasury – The Ark of Real Value – Hold portable, physical wealth in precious metals, held securely and compartmentalized, beyond the reach of confiscation.

Ring 3: The Liquid Veins – The River of Cash – Maintain cash reserves in diversified currencies to navigate immediate and medium-term crises.

Ring 4: The Web of Influence – The Network of Reciprocity – Build trusted family and community networks for mutual aid, barter, and collective resilience.

Ring 5: The Outer Shadow – The Legal and Jurisdictional Moat – Use legal, geographic, and structural strategies to shield assets and create asymmetric protection from asset seizure.

Ring 0: The Inner Keep – The Sovereign Mindset

This is the foundation of the Citadel Strategy. Before buying a single ounce of silver or an acre of land, you must secure the “Inner Keep”—your own mind. This is the psychological fortress where you deprogram yourself from reliance on a system that plans to dispossess you. It is about moving from dependency to radical personal responsibility.

The system’s greatest weapon is normalcy bias—the tendency to assume tomorrow will look like today. This bias blinds people to incrementalism: the deliberate, step-by-step erosion of freedom, security, and wealth. Each new regulation, cost increase, or loss of rights may seem minor on its own, but over time these small changes accumulate, steering people toward eventual annihilation. Even shocks that should provoke outrage—like the mass poisoning of family and friends during Covid or the revelations and gaslighting surrounding the Epstein files—are gradually reframed and normalized, reinforcing the illusion that all is “normal.” But what is happening isn’t normal—it’s deeply disturbing.

This realization should not paralyze you with fear. On the contrary, it should ignite action. Falling into despair, or convincing yourself that there is no hope, is itself part of the psychological operation designed to neutralize you. You must reject it. The correct response is to seize your agency—to recognize that you are responsible for your own survival, security, and future, and to act accordingly.

Seizing your agency means moving from victim to architect. It means accepting that nobody is coming to save you—and that you alone are responsible for your success or failure in life. This shift in mindset is deeply empowering. It moves you from passive dependence to active participant, and enables you to build a life resilient to shocks of all kinds, including the Great Taking. When you do this, you become sovereign, as our creator intended.

Cultivating a Depression-Era Attitude

To strengthen the Inner Keep, we need to cultivate what I call a “Depression-Era attitude.” This is the mindset of the generation that survived the Great Depression—grounded in practical resilience and real-world self-reliance. We can break it down into the three R’s:

Readiness: Think ahead. Don’t wait for the news to tell you something’s wrong—you plan for crisis long before it arrives. Those who survived the Great Depression did so because they were already prepared going into it.

Resourcefulness: We should anticipate unexpected problems. Resourcefulness is the ability to meet them calmly, improvise, and see problems as puzzles rather than dead ends.

Ruggedness: This is our ability to endure discomfort and maintain the stamina to keep moving forward when conditions deteriorate. It is built by keeping life simple and reducing our dependence on modern comforts. Voluntary hardship during good times—intense daily exercise, cold showers, fasting—cultivates this kind of grit. It ensures that when real hardship arrives, you are already psychologically adapted to it.

The Inner Keep—fortified with a sovereign mindset and a Depression-Era attitude—is the bedrock of the entire Citadel. Every other fortification depends on it. Without Ring 0, you are unlikely to succeed in protecting your family’s wealth, and quality of life. It is what allows you to see clearly, act decisively, and take full responsibility for your future. The good news is that once you build out the inner keep, it cannot be taken from you. It is the one asset that is truly immune to confiscation.

The Shackles of Debt: The Primary Lever of Control

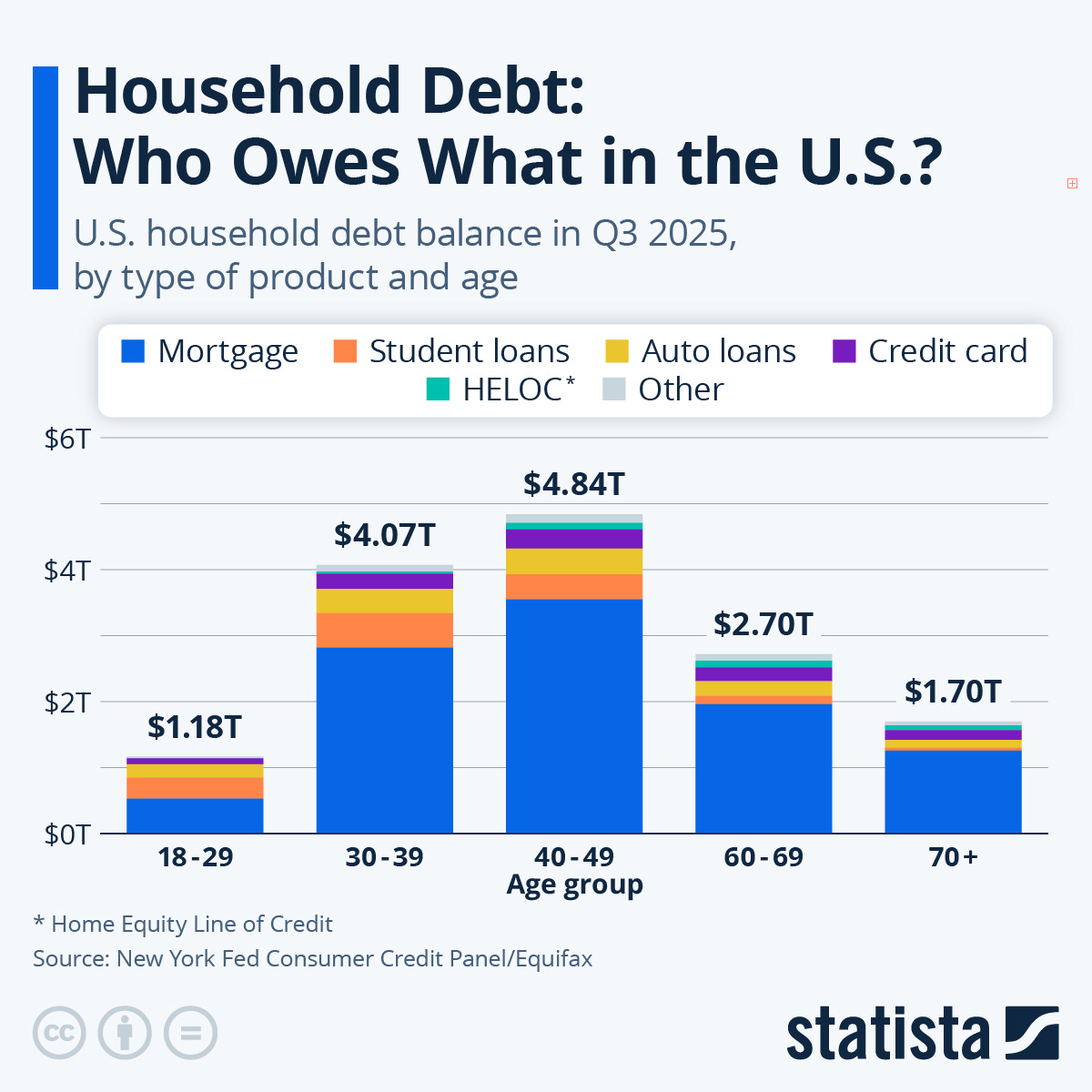

Before you can build a Citadel, you must first ensure you are not standing on quicksand. The most dangerous vulnerability in the face of the Great Taking is debt. You must understand this clearly: If you have debt, you do not own your assets. If you have a mortgage, the bank owns your home; you are merely a tenant with a liability. If you have a car loan, the dealership owns the vehicle. In a systemic collapse or a Great Taking type event, debt is the primary lever used to strip wealth from the population. This is something David has mentioned many times in interviews.

In a deflationary collapse—which often precedes or accompanies these resets—asset prices collapse, wages vanish, and both credit and liquidity dries up. However, the nominal value of your debt remains fixed. You could find yourself owing $500,000 on a home that is suddenly worth $100,000, while your income has been cut in half, or lost entirely. This was the trap during the Great Depression that allowed institutions to foreclose on millions of properties, transferring real assets (land and housing) from the people to the banks for pennies on the dollar. At the height of the Great Depression unemployment was over 25% and over 60% of all mortgages were in delinquency. Over 1000 properties per day were being foreclosed on. I expect these numbers could be eclipsed in the coming downturn.

For these reasons, the ruthless elimination of all debt—consumer, vehicle, and especially mortgage—is not just a financial goal; it is a prerequisite to financial and spiritual sovereignty. You cannot be sovereign if you are in bondage to the very system you are trying to protect yourself against. Pay it off, downsize, or sell the asset to clear the note. Better to live smaller in a debt free property that is truly yours, than in a mansion or large acreage that belongs to the bank. So beyond developing a sovereign mindset, step number one financially speaking, is to break the shackles of debt.

Now let’s move on to the five outer rings.

Ring 1: The Physical Bastion – The Unassailable Homestead

The most important protection against systemic collapse and the Great Taking is what I call the Unassailable Homestead. In a fragile future, a homestead is far more than a place to live — it is the foundation of your families security and resilience, and a space you can truly thrive. If everything else fails, it keeps you safe, allows you to meet your basic needs, and supports both mental and physical wellbeing. Over the long term, it also reduces costs, can generate income, and insulates you from financial shocks by removing your dependence on volatile energy and food prices.

History shows its importance. During the Great Depression, the key factor determining whether someone survived or ended up in a soup line was their exposure to debt and their immediate living situation. Farmers who owned their land outright generally survived with relative ease. When the credit system failed, unemployment spiked, and cash became scarce, they were largely unaffected—they could provide for themselves in-house. Fortunately for us, natures abundance doesn’t follow the business cycle.

Worth pointing out, the modern way of living, now ubiquitous in the West, is a complete historical aberration. Our ancestors rightly built layers of insulation during the good times knowing that hardship was always one crisis away. Waiting until hardship arrives means you’ve already missed the boat. By then, it’s too late. This is why you should aspire to build your Unassailable Homestead as soon as possible. It should be debt-free, have off-grid solutions, be located away from major urban centers, and ideally surrounded by like-minded, self-reliant neighbors. This creates many layers of additional protection in terms of food, water, and security, while offering a marketplace right there on your doorstop for trade and barter, should a crisis suddenly emerge.

It doesn’t need to be an all-singing, all-dancing farm. Simply owning land where you can grow food and practice self-reliance is enough. For those with less capital, living in a camper, trailer, or tiny house for a year or two to secure the land is often worth the sacrifice. I speak from experience: I lived on an 8-meter boat for five years to save money and eventually buy my homestead debt-free.

For many, this represents a radical departure from their previous life. But if real peace of mind is the goal, this is how it is built. Right now, we are in the midst of a major property bubble in the West. When it bursts, residential real estate values will collapse. At the moment, there is still an opportunity to sell these overvalued ‘assets’ (soon to be liabilities) and use the proceeds to acquire property that will truly serve your needs in a crisis — the kind of property that becomes far more desirable, not less, when SHTF.

This kind of property is more than a home; it’s a base for your family and your real-world assets. Our great-grandparents didn’t own stocks or NFTs. They invested in themselves and their farms. Just think how wild it is that today, millions of people have seven digit brokerage accounts and yet have no way to feed themselves or survive a cold winter without centralized systems. They are nominally wealthy, but in practical terms, they are poorer than poor.

When a real-world crisis strikes, be that the Great Taking or some other major systemic shock, the humble farmer will outlast them — both financially and practically. Our great grandparents would have never put themselves in such a sad position. They understood that the family homestead, was not only their primary investment, but their primary means of survival. They never expected big daddy government to keep them. The idea would have been absurd. It’s a stark reminder of just how dependent—and psychologically backward—we’ve become. The Unassailable Homestead fixes that.

Some Ideas for Strategic Land Acquisition:

Location, Location, Obscurity: Prioritize low population density areas with a culture of self-reliance. Avoid locations near large government facilities, dams, power plants, landfills, or military bases. Consider access to natural resources, proximity to borders or waterways, and risks like forest fires, flooding, or extreme weather. Choose a site that maximizes both security and sustainability.

The Water Imperative: Reliable water is non-negotiable. A well is essential—test its flow and quality. Supplement with rainwater harvesting systems, gravity-fed filters, and storage tanks to create redundancies. Water access determines how resilient your homestead can be, both for daily needs and in crisis.

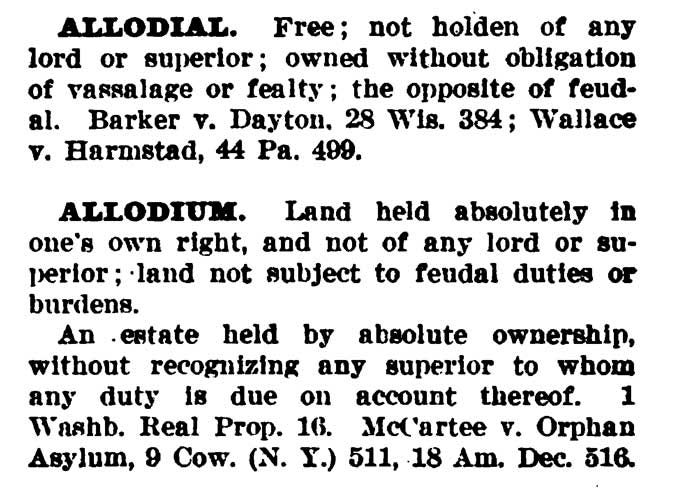

Title and Ownership: Debt is vulnerability. Own your property free and clear. Explore strategies for pursuing allodial title or a land patent, which can shield your property from taxes and seizure. Keep physical copies of deeds and land registry documents. Living modestly and debt-free is far safer than stretching to acquire a “dream” property with loans.

Asset Diversification: Your homestead is a primary survival asset, but it can also generate income. Sell surplus produce, firewood, or livestock. Install a small sawmill, greenhouse, or solar-powered workshop. Turning your land into productive, real-world assets ensures it holds tangible value, even in extreme economic conditions.

Turning Your Homestead Into an Off-Grid Fortress:

Energy Independence: Design a layered energy system. A primary solar array with lithium-ion battery bank, backed by a propane or diesel generator, covers daily needs. A secondary smaller solar setup should handle critical loads—well pump, fridge, security systems. Also, get comfortable with a low-tech, low energy-use lifestyle. This isn’t a sacrifice, it’s a return to reality. The American dream is actually a nightmare, one that made you sick, weak and mentally unwell. Of course, ensure you have a wood stove and access to firewood, either on your property or nearby.

Food Production Systems: Go beyond a simple garden. Build a permaculture food forest with fruit and nut trees, berry bushes, and perennial vegetables that produce food with little need for further input. Establish annual gardens for staples like potatoes, beans, and corn. Include small livestock: chickens for eggs and meat, goats for milk, rabbits for protein. Save seeds, compost, and rotate crops. The goal is a homestead capable of supplying a decent portion of your family’s food without requiring full-time labor.

The Food Pantry: One of the cheapest and most important “investments” you can make — which can be set up almost immediately — is a food pantry stocked with a year’s supply of food. Yet so few people actually have one, even though most of us are aware that if supply chains falter, supermarkets will empty in a matter of days! If you take one action after reading this article, let it be this. Create a food store. On a homestead, this is especially easy to implement. With space to store cans, jars, and plenty of surplus produce, you can preserve food year-round and build real food security.

Security in Depth: Security goes beyond firearms, although you absolutely should own and become proficient with whatever is legally available in your country. Beyond this use natural and physical barriers: perimeter fences, thorny hedges, ditches, or berms. Protect the property with dogs, alarms, and surveillance systems. Create a family defence plan and a safe place for relatives who can’t secure their own homestead. Blend into the local community, avoid displaying wealth, and practice operational security. Physical assets may survive systemic collapse, but human threats require strategy and foresight.

Land & Forestry As an Investment Class

Developing a homestead is one of the most practical ways to grow real, tangible wealth. Over the coming decade, demand for properties like this is only going to increase. At the same time, supply will collapse as prices skyrocket and more people rush to get out of the cities.

Any improvements you make along the way directly increase the value of the land. Things like:

Planting fruit trees or trees for timber

Establishing gardens or fruit orchards

Digging ponds and stocking them with fish

Adding off-grid energy systems and infrastructure

Maintaining a herd of cattle or flock of sheep

Similarly, I also recommend land in general as an investment. This could be parcels of land or forestry separate from your main dwelling, held for capital appreciation and to provide you with additional resources. Unlike most assets, land is largely uncorrelated with the stock market and tends to move more in line with gold. In my opinion, at some point land will become nearly impossible for regular people to buy—as the elites are snatching it all up, which tells us something important. Securing some now is vital!

Of course, land is also inherently Great-Taking-proof. Owning it outright ensures it cannot be collateralized in any way. A smart strategy is to invest in land close-by—within about 45 minutes of your main property. This creates a secondary asset that’s close enough to manage, yet completely separate from your primary homestead. If you ever decide to sell it, you can do so without affecting your main property, making it a fully independent asset.

A Final Word of Warning

When you choose to go back to the land, particularly if you spent your life living in the city, expect some opposition from friends and family who don’t see what you see. Going against the grain always provokes pushback. My wife and I experienced the exact same thing. A true contrarian knows this is a good sign; siding with the crowd during these periods of history is almost always a terrible decision. Similarly, doomers will tell you, “It’s pointless; they’ll send drone swarms to kill you and seize your homestead,” or “good luck when the roving mobs come to loot you.” These people are irrelevant and destined to be the first to fall.

They don’t have a sovereign mindset—they have a slave mindset. The battle has barely begun, and they’ve already surrendered. Worse, they are actively seeking to poison others, and deter you from taking action. That is unforgivable. We know the risks; our task is to find solutions. But for these people, your action is threatening—because it holds a mirror to their cowardice or laziness.

I suggest reducing your exposure to these kinds of people as much as possible. When these people appear in my comments section, it’s an instant block. They don’t want to be helped, only to deride those who are taking action to make themselves feel better about their own inaction. It’s about as bad a take as you could have. There has never been a point in history where taking preventative action didn’t make sense and increase a person’s chances of success.

Yes, there are no guarantees, and there is every chance that a true tyranny will turn its attention to the survivors also—I covered this in my introduction, but the future is not a foregone conclusion. Irrespective of what happens, building your Citadel will give you and your family far more health, happiness, and opportunity, than you would otherwise have had. Meanwhile, Mr. Doomer will be shipped off to the nearest 5-minute city at the first sign of trouble — having lost it all because “there was no point in preparing” and thus, he was left with no other option.

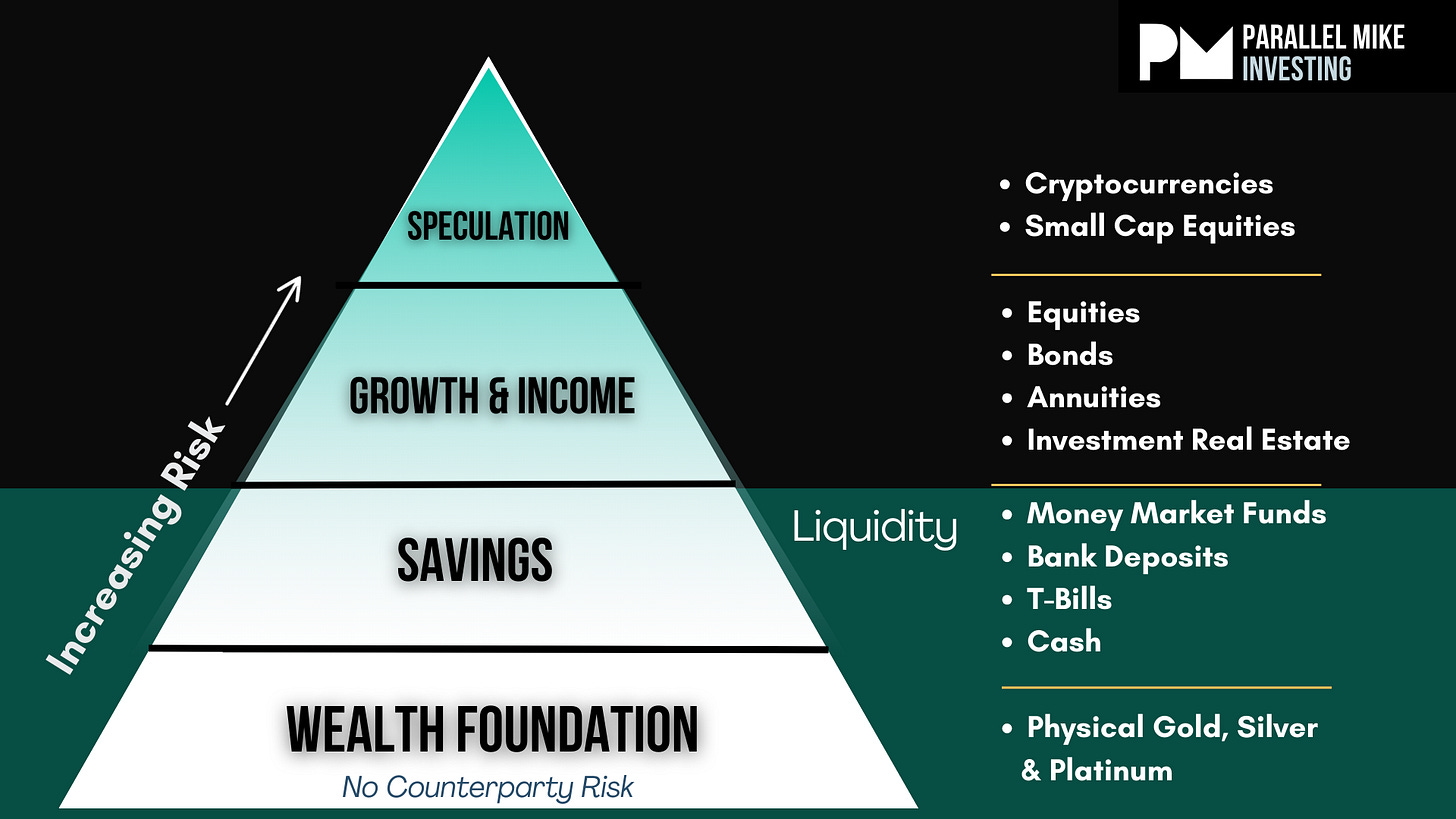

Ring 2: The Treasury - The Ark of Real Value

This ring is the repository of your portable wealth. It is designed to survive the collapse of the fiat currency system and serve as the foundation for a new one. To understand why this ring is necessary, we must look at the inevitable destination of the current financial path. Everything we see is pointing to a financial reset. I was predicting this long before I knew about the Great Taking, and I remain steadfast in that opinion.

Why Metals Are The Best Store of Wealth To Protect from the Great Taking

When you hold a physical gold/silver coin or bar in your hand, you possess the asset outright—it is not a promise to pay, it is value itself. This is the only asset class that exists entirely outside the digital ledger and the reach of a sudden default or confiscation. Right now, we are seeing a rush into precious metals as key financial players realize the massive default that is incoming. Take heed. It’s no surprise to me that since the Great Taking book was released, the gold price has more than doubled.

The Trinity of Metals

Gold (The Core): Physical gold is the ultimate long-term store of wealth, a role it has fulfilled for over five millennia. Unlike financial or digital assets, it cannot be defaulted on, wiped out in a fiscal crisis, destroyed by a cyberattack, or lost to a counterparty. This makes it the lowest-risk asset in the world, and yet, despite this, it has been the best-performing asset over the past 25 years.

As the financial system resets, it does so against gold, ensuring strong demand from central banks and wealthy families for decades to come. In the context of the Great Taking, the foundation of your wealth preservation must begin with gold. It is the bedrock of any portfolio—a principle you can explore further in my article on the Wealth Preservation Pyramid.

In order to maintain true flexibility and liquidity, you must diversify both the forms of gold you hold and their storage locations. Gold is the densest, most portable store of value—far easier to transport in a crisis than silver—making it the cornerstone of any robust Citadel strategy.

Diverse Types and Sizes: Do not limit yourself to standard 1-ounce coins. You should acquire a mix of different types of gold—such as sovereign coins (American Eagles, Canadian Maples, Krugerrands), gold jewellery, ex-circulation gold and bars from reputable refiners. Each type of gold has a unique role to play in your portfolio.

Of course, be aware of hidden legal traps. Coins of the realm, for example, could be targeted in a confiscation because they function as legal tender—I’ve discussed this in past articles. While vaulting has its place, placing 100% of your wealth with counterparties is a dangerous strategy during a major systemic crisis or financial reset. In such scenarios, these assets become low-hanging fruit for bankrupt governments.Granular Liquidity: I also recommend fractional gold bars in 1 g and 2.5 g (or 2 g) sizes, along with 1/10 oz and 1/4 oz coins. As gold continues to reprice upward against debt-based assets, these smaller units allow you to liquidate only what you need, when you need it—rather than being forced to sell a full ounce to cover a minor expense. Just as importantly, fractional gold future proofs your portfolio. Already in Europe, sales of goods (including metals) above €10,000 trigger mandatory reporting.

Silver (The Circulation): Silver is best viewed not as an investment, but as your day-to-day barter currency. Pre-1965 US 90% “junk silver” coins are ideal: universally recognized, easily divisible, and can be bought very close to spot. Supplement them with generic 1-ounce and 10-ounce rounds or bars. In a true crisis, silver becomes a practical payment mechanism to buy goods and services, giving you real liquidity and flexibility even when conventional money loses its value.

Platinum Group Metals (The Hedge): A smaller allocation (5-10%) to platinum and palladium, whilst not necessary, can provide diversification. These metals have significant industrial demand and often move somewhat independently of gold and silver, protecting you if one market is manipulated or suppressed, or a confiscation order makes our preferred metals illiquid for a period of time.

Financial Privacy: The Digital Cloak

Before acquiring physical metals, it’s essential to obscure the trail that leads to them. This is a critical step in protecting your wealth from potential future confiscations. While gold and silver in your possession cannot be lost to the Great Taking, history shows they can still be targeted in subsequent waves of seizure.

Breaking the Chain of Custody: Avoid purchasing metals using a credit card, bank transfer, or check that creates a permanent record linking your identity to the specific assets. Use cash whenever possible. The goal is to ensure that there is no centralized database listing your name next to your holdings. Be aware of any reporting thresholds in terms of amount also. In the UK, for example, buying more than £5000 of gold in a single purchase or £10,000 in a 12 month period from the same dealer must be kept on file. If the government requests this information, the company must turn it over.

Records of Your Transactions: If you maintain digital records or physical receipts of your holdings, store these records on devices or USB drives that are encrypted, and in a private location (e.g. a safety deposit box). For obvious reasons your gold and silver should not be listed on any official document such as a will or insurance policy—lest you are happy advertising your wealth to a system seeking to dispossess you of it.

The Principle of Compartmentalization: Never, ever store all your wealth in a single location—not even in the best safe. Your Citadel’s treasury should be divided into at least three, and ideally five, separate locations. For example, one location could be buried somewhere obscure; another at a trusted family member’s property; a third in a selection of private vaults outside your country.

Prepare For Potential Confiscation: Gold confiscations are as old as time. Failing to factor them into your broader strategy — and your gold portfolio — is a serious mistake. Having studied past confiscations extensively, I can say that effective protection requires careful planning, far too much to cover here. That said, holding some gold in the most trustworthy offshore vault possible, in the correct jurisdiction, is a good place to start.

Ring 3: The Liquid Veins - The River of Cash

While the ultimate goal is to move beyond fiat currency, the financial reset will almost certainly unfold in stages. During the phase when the system is stressed but not yet fully broken, physical cash remains king. But what happens if banks begin to fail or governments impose strict withdrawal limits, as happened to Greek citizens during the Eurozone crisis? Banks could deny access to your deposits, ATMs could go dark, and yet cash will still be essential to survive.

Be warned: Deposits held in the bank are not your own. It's a loan unto the bank and therefore exposed to 100% loss and an eventual bank bail-in. Deposit insurance schemes are worthless and in a true crisis even solvent banks and well run credit unions are at risk. Many of them will have a target on their back given it will be the Federal Reserve system who picks the winners and losers.

Even without a full blown banking collapse, it’s becoming worryingly normal for bank accounts to be weaponized—just look at the Canadian truckers’ protest. Having some physical cash is one way to protect against this. While fiat currencies are clearly a terrible form of long-term wealth preservation, in the short to medium term, they remain critical for our day to day economic survival. History shows us that before people lose their assets—they first lose their liquidity. Those who maintain it, ensure they can buy essentials, avoid incurring debts, and travel, whilst those who failed to prepare are busy rioting outside shuttered banks.

For this reason, you should keep enough cash on hand to cover at least three months of expenses. For those preparing for a Great Taking scenario, a more comprehensive approach is the cash ladder.

The Cash Ladder:

Tier 1 (Immediate): $5,000-$10,000 in small bills (1s,5s, 10s,20s) stored in a safe location. This is for the first 30-90 days of a crisis, for buying last-minute supplies or paying for local services.

Tier 2 (Strategic Reserve): A larger sum, $10,000-$20,000, set aside for an extended crisis which includes withdrawal limits. This is your bridge for a 6-12 month period of disruption.

Tier 3 (Go Fund): $1,000-$2,000 in mixed bills, hidden in your vehicle or a grab-and-go travel bag. This is for emergencies that require immediate evacuation or for a crisis situation which emerges whilst your traveling.

Currency Diversification: It’s smart to not rely solely on your local currency. Hold a portion of your Tier 2 and Tier 3 cash in desirable foreign currencies such as the U.S. Dollar (USD), Swiss Francs (CHF) and to a lesser extent, Euros (EUR) or Chinese Yuan (CNY), depending on your location.

Are Our Retirement Accounts at Risk?

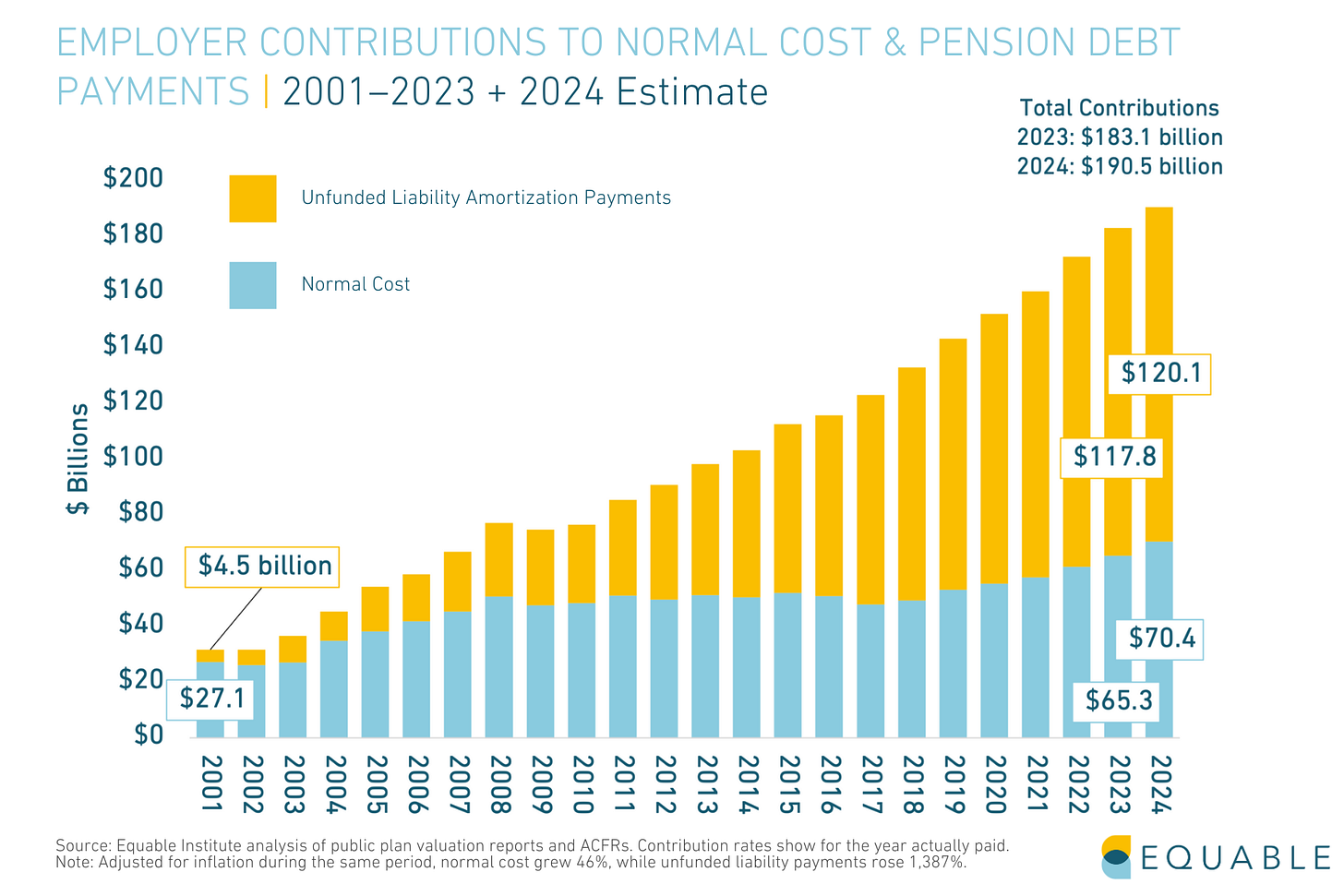

The short answer is yes, our retirement accounts are sitting ducks. One of the hardest conversations I have with clients is explaining that, regardless of whether the Great Taking occurs, their pension is extremely vulnerable to total loss. The entire system is structurally broken. Most pension funds are undercapitalized, fragile by design, and fundamentally unsustainable — hollow shells propped up by promises that cannot be kept. And this is before a major financial downturn has even begun!

At the same time, the stock market sits in a historic hyper-bubble, a ticking time bomb waiting to explode. Sovereign debt will be defaulted on — either through the silent theft of inflation or outright repudiation. Yet these two instruments, equities and government debt, form the backbone of most private pension schemes.

In the coming crisis, the vast majority of pension funds, 401(k)s, and retirement accounts will be annihilated. And if the Great Taking does occur, even the most pristine and well-capitalized funds will be seized, leaving beneficiaries with nothing. All of this will unfold alongside collapsing housing prices, banking crisis, and soaring unemployment. This may sound like a doomsday scenario, but that is actually the point. The dominoes have been deliberately arranged this way, so everything fails simultaneously. A controlled demolition that immediately eviscerates the wealth of most citizens.

Of course, for those who have spent a lifetime paying into these systems — and who have spent decades psychologically investing into the illusion that their retirement account will be there and provide security in old age — this is a bitter pill to swallow. The instinctive response is often denial: “But my fund is different…they assure me my fund is safe.” You must resist the temptation of self-delusion.

It goes without saying that government pensions are dead in the water. Our nations are already insolvent. Future payouts will likely devolve into a form of conditional UBI — subsistence-level support tied to behavioral compliance. Anything controlled by government will be used to control you. Period.

Ok, so now we have had our reality check, what can we do about it?

Firstly, for those who can access their pension early, why wait? Keeping it in the fund, ensures it remains vulnerable to all of the above. For those unable to fully liquidate their accounts and convert them into real-world assets, establishing a self-invested personal pension (SIPP) or a self-directed IRA is the next best option. This provides far greater control over the underlying assets. In many jurisdictions, pension funds can be allocated into vaulted metals held in your own name — offering the best chance of preserving both your retirement savings and the assets themselves when the music stops.

Ring 4: The Web of Influence - A Network of Reciprocity

Wealth is not just what you own, but who you are connected to. In a true systemic crisis, the financial system will freeze, institutions will fail, and the atomized, isolated individual will be helpless. An unassailable homestead and layers of liquidity will ensure your immediate survival, but longer term, you need a network of trusted, capable individuals. A community. This is your most powerful and enduring defence—one that cannot be confiscated, frozen, or devalued by any central authority.

Community Begins at Home

The atomization of modern society did not happen by accident. Over the past century, powerful forces have systematically dismantled the multi-generational family. Children move far from their parents for careers — having been indoctrinated by electronic devices and public schooling. Grandparents are warehoused in nursing homes — desperate institutions designed to drain a lifetime of accumulated wealth before death, ensuring nothing is passed down.

The nuclear family itself has fractured into isolated individuals, each dependent on the system for needs once met by kin. This is not progress; it is a control mechanism. An isolated individual is easy to manage and easy to dispossess. They know this, which is why the scamdemic was so successful. It’s much more difficult to take everything from a man surrounded by three generations of loyal kin; even harder if he has an entire community behind him willing to help protect his property and rights.

A key protection from future hardships is, therefore, rebuilding family bonds. Reconcile with your children or parents. Strengthen bonds with siblings. Consider a return to inter-generational living — where grandparents provide wisdom and childcare, adult children contribute labor, and elders are cared for at home, not abandoned to institutions that quickly consume their estates.

Beyond economics, this rebuilding creates meaning—the profound purpose that comes from sacrifice for those who came before you and those who will come after. The joy of living with grandchildren, the wisdom of elders, the shared pride in building something that outlasts you all. It is your loving connections — not your money — that they want to loot from you the most. A family, rebuilt and united, is the ultimate act of defiance in the modern world—and the best protection against despair and isolation.

The Mutual Aid Pact

Beyond family, you can begin to build alliances within your broader community. Consider local churches, neighbors, and anyone living a similar lifestyle of self-reliance. Reach out. Make connections. Become a resource by buying directly from them—their eggs, their produce, their services. Find ways to offer something of value back to your community, whether skills, labor, or goods from your own surplus.

This is not merely about preparing for crisis; it is about building a network of trusted individuals you can turn to for support. History proves that a unified community is extremely difficult to dispossess. In communist Eastern Europe, the Soviet system crushed individuals and isolated families with ease, but they had no answer for the Polish farmers. Despite decades of pressure, collectivization failed in Poland because the farming communities were too numerous, too interconnected, and too stubborn to break. There were simply too many of them, bound together by shared faith, culture, and mutual dependence.

During the Great Depression, many farmers rallied around neighbors who had fallen behind on their mortgage payments, and ensured auctions of foreclosed went no bid. So families about to lose their homes could buy it back at the lowest price possible. A community rooted in genuine relationships and economic interdependence becomes a fortress that no central authority can breach. This is also where your trade and barter economy comes in. The real ‘real economy’ during a systemic crisis.

Formalize Wherever Possible

As trust deepens, consider formalizing arrangements with your closest allies—3-5 families with complementary skills: medical knowledge, security experience, mechanical ability, agricultural expertise. Draft a plan covering mutual defence, resource sharing, and communication plans—for a worst case scenario. Meet regularly to strengthen bonds. The trust built over shared meals and honest labor is the glue that holds a community together when the pressure comes.

Build a Global Network

Whilst building real world community is imperative, it can take time. The internet allows you to connect with like-minded people worldwide with ease. People who are already building their own Citadels who you can learn from. Cultivate this network now. A global network becomes an important intelligence asset—alerting you to developments across jurisdictions, warning of threats, and potentially offering refuge or partnership.

Ring 5: The Outer Shadow - The Legal and Jurisdictional Moat

This is the final ring of defense. It leverages legal and geographic strategies, turning the system’s own complexity against itself. Some of these strategies are more complex, costly, or require professional guidance, and may not be feasible for everyone. As the outermost layer, they are less critical than the inner defenses, but they are still worth considering.

Escape the “Securities Entitlement” Trap

The core mechanism of the Great Taking is the legal transformation of ownership into mere “securities entitlement”—a contractual claim that places you behind secured creditors. The solution is to demand physical paper stock certificates. This removes your shares from the DTC or Euroclear system and gives you back direct ownership, bypassing the Great Taking mechanism for equities.

The Dual-Purpose Portfolio

Maintaining a small portfolio of investments within the traditional system can have advantages even in-spite of the Great Taking. This serves two purposes:

Sacrificial Anode: It makes you appear like a normal citizen, flying under the radar. In a seizure event, this decoy may satisfy the system’s initial appetite, drawing attention away from your main wealth. It can also be used to justify how you are funding your activities.

Opportunity Fund: A crisis that doesn’t result in the Great Taking will create extraordinary dislocations. Quality assets will trade for pennies. Maintain liquidity to deploy capital when others panic. A properly structured portfolio can leave space to potentially acquire assets at generational discounts.

Digital Minimalism & Online Privacy

Minimize your long-term digital footprint. Use VPNs, privacy-respecting browsers, and encrypted email. This will help keep you invisible to the system ahead of any future wealth confiscations. Your public facing digital identity should be bland, ensuring your real wealth remains as invisible to the system as possible.

International Private Vaults

Establish accounts with non-bank vaulting firms in jurisdictions with strong financial privacy—the Cayman Islands, Switzerland, Austria, Panama, or Singapore. These firms are less likely to be subject to “bail-in” laws. Your gold in a private vault in Zurich is not subject to an executive order signed in Washington.

Foreign Legal Structures

It’s possible to create a Foreign Asset Protection Trust (FAPT) in the Cook Islands or Nevis, or a Nevis LLC. These entities are designed to be extremely difficult and costly for foreign courts to pierce. An asset held by a properly structured Nevis LLC is shielded by a legal and geographic moat that would require years of litigation to breach—making it not worth the effort.

Private Banking Relationships

For those with sufficient assets, private banks in Switzerland, Liechtenstein, or Singapore operate under different legal frameworks than retail banks, offering greater privacy.

Second Residencies and a Plan B

Consider a secondary property within a completely different jurisdictional profile from your primary homestead—a place to retreat if, for any reason, Plan A becomes untenable. Having multiple residences can ensure you have a place to escape to, as a last resort, if you need to leave your home country.

Learn How to Manage Risk Continuously

What I’ve outlined here is only the first step — albeit a substantial one. I’ve focused on the most vital components for obvious reasons; this article is already something of a tome. But risk management is an ongoing process, not a one-time event. The future is unpredictable, and there is no permanently safe position. Unfortunately, most financial advisors and wealth managers are simply not aware of the kinds of risks we are now facing. So we must become competent in protecting and managing our own wealth. Nobody else should be trusted to do this for you.

Twice a year I facilitate Group Coaching for Investors where I support people to learn the same wealth preservation skills and strategies I am using to protect and grow my family’s wealth, going into the reset. For those who would like to join us, our next group begins at the end of February.

In Closing

As we move into harder times, the goal is not to fight the system head-on—that is a battle you will almost certainly lose. The goal is to defend ourselves against it, by becoming sovereign and resilient. If the Great Taking ensues, the system is engineered to take what is easiest to seize: digital accounts, brokerage portfolios, domestic vaults, mortgaged property, and pension funds or 401(k)s—all of which are neatly catalogued and trapped within the system. At this stage, it’s unlikely we can stop them, but your Citadel, deliberately built across all five rings and standing in the shadows, remains far beyond their reach.

For many, achieving even half of what I have outlined will be a serious undertaking. The good news is many people have already conquered this mountain. There is a tried and tested route, I speak from experience, given I have played the role of mountain guide for many. Whilst the Great Taking would be a catastrophe, we cannot say for certain if, or when, it will occur. What is certain, historically speaking, are cyclical downturns that bring real hardship. Stock market and housing market bubbles will eventually burst. Fiat currencies cannot last forever. Economic depressions are guaranteed in a debt-based system. These are not hypotheticals, but inevitabilities. We are seeing warning signs that all of them are potentially on the immediate horizon.

Personally, I don’t see this path as a sacrifice; I see it as a gift. Moving to a homestead and reducing dependence on systems that no longer serve us—if they ever did—is something to celebrate. Everybody I know who has taken this path is healthier, happier, and living a more meaningful life then they once did. These are the rewards that come from exiting the casino, and returning to what’s real. A genuine alternative. A future worth fighting for. For those who made it this far, I’ll close with a simple truth:

“The best time to plant a tree was 20 years ago. The second-best time is now.”

Take meaningful action, and build a life that allows you to thrive.

GROUP COACHING FOR INVESTORS BEGINS FEBRUARY

I’m excited to let you know that bookings are now open for the February cohort of Group Coaching for Investors. Group coaching is your opportunity to learn the skills and knowledge required to preserve and grow your wealth going into the reset.

Because group coaching is delivered live with Mike on Zoom, the cohort is kept intentionally small to ensure everyone gets real value. For that reason, spaces are already limited.

What’s included in group coaching:

12 sessions live on zoom

Each session focuses on a key topic, including the Great Taking, protecting pensions and 401(k)s, gold and silver strategies, ratios, cycles, and more

Group discussion and Q&A after every session

Wealth preservation skills and strategies I am actively implementing to protect and grow my families wealth going into the reset

Additional workshops you can watch in your own time

Access to my monthly investor mastermind, where market risks and opportunities are discussed

For more information on group coaching, please click here. If you would like to discuss potentially joining us for group coaching or have any questions, please email parallelsystems@protonmail.com

SUBSCRIBERS ONLY CONSULTATION OFFER

In recent weeks I’ve received a number of inquiries regarding my availability for 1–2–1 consultations. For more than four years I’ve been guiding clients towards positioning themselves and their families to protect their wealth during the high-risk environment we are now in.

From managing the Great Taking and asset confiscation, to protecting pensions and 401(k)’s — this is where I specialize. I also support people with creating a Plan B and preparing to become more self-sufficient. Normally, I only offer a limited number of consultation slots each month, but given what is unfolding, I am opening my diary up in the coming months to focus on consultations.

As a thank-you to my subscribers for their support throughout 2025, I am offering 20% off all consultations booked before the end of January. This is the first time I have ever discounted my consultations.

As such, if you would like personal, one-to-one support to secure your wealth, now is a great time to book. The discount can be accessed via the link below.