The Silent Pact: Gold’s Role as the Ultimate Liquidity Sponge

Have They Agreed To Take The Brakes Off of Gold To Stabilize The System?

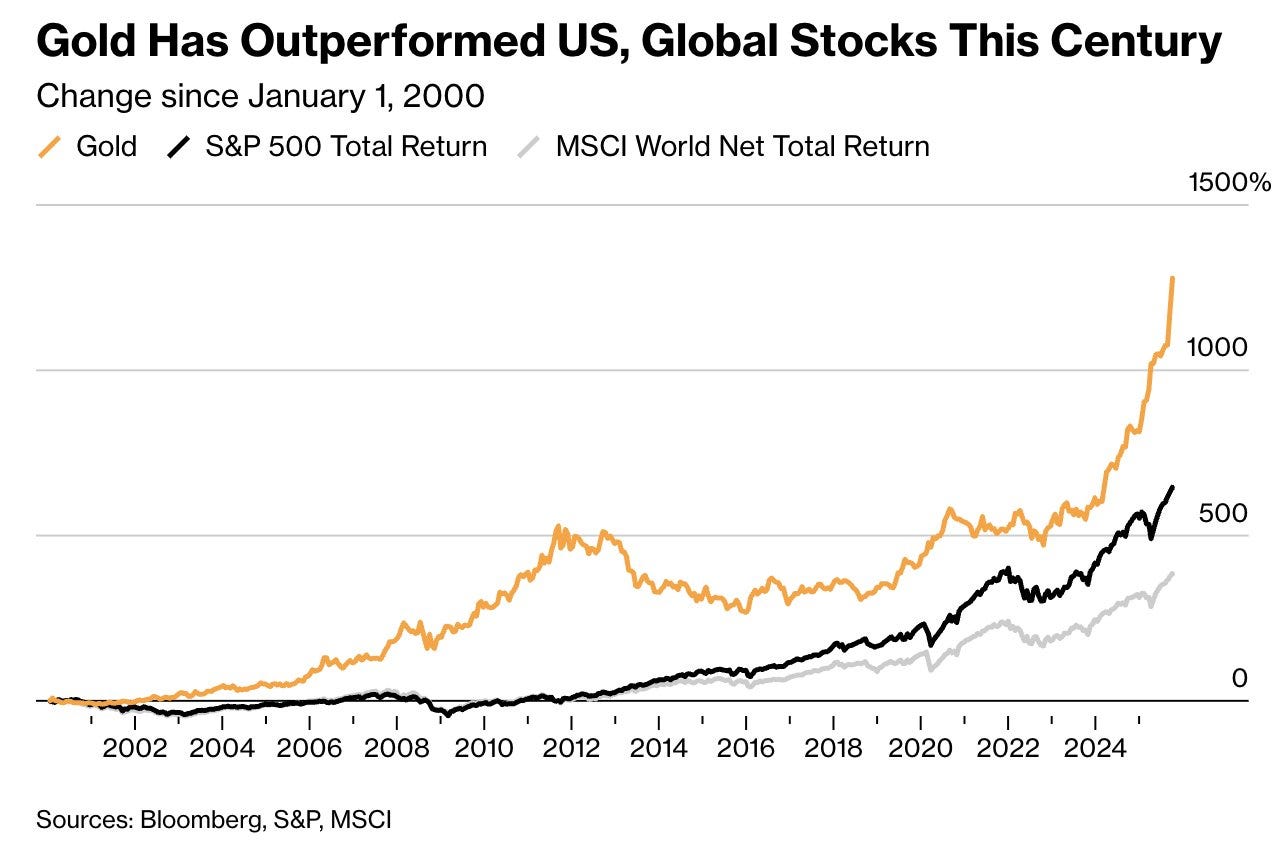

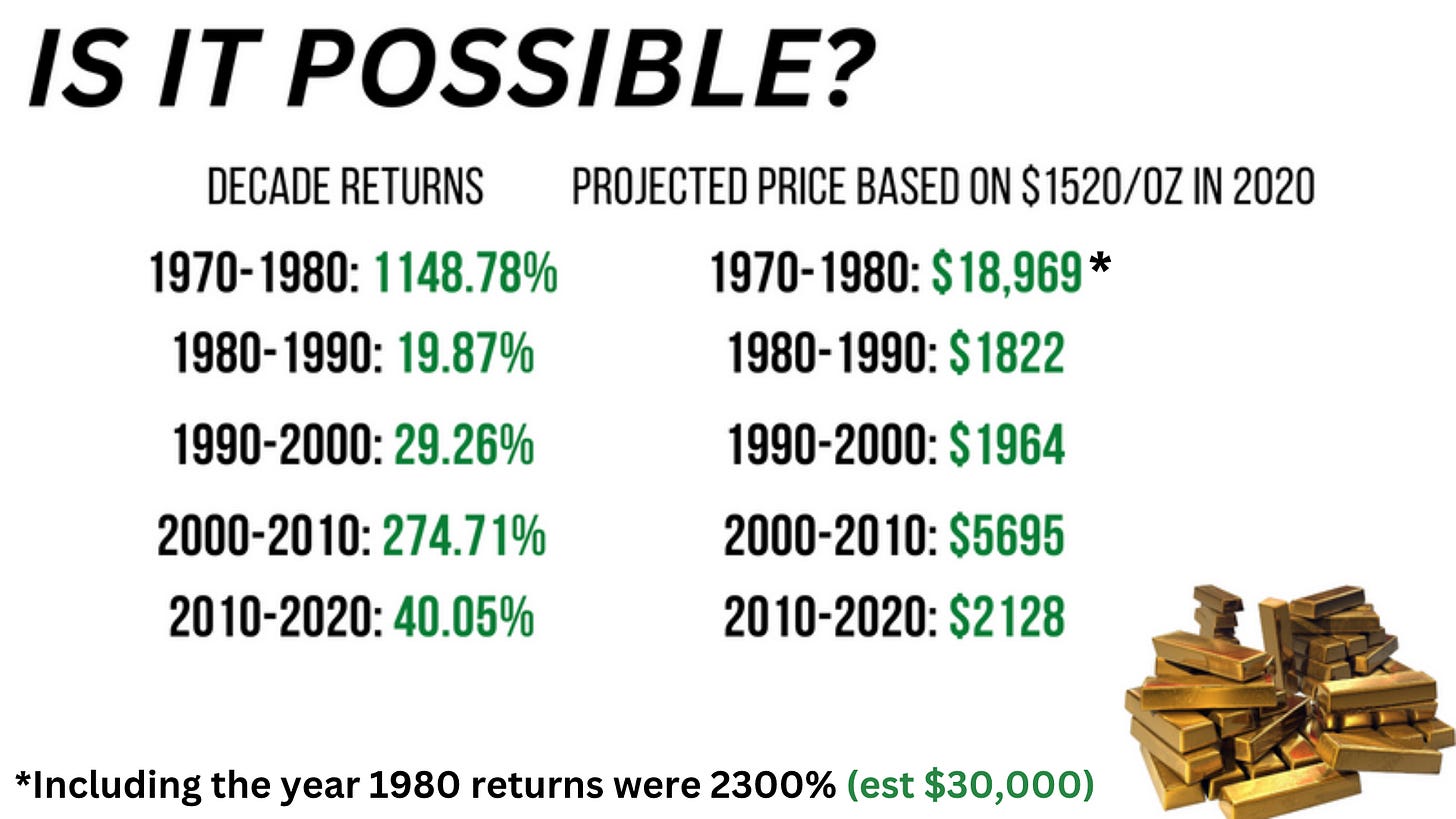

Gold’s performance this year has been nothing short of historic. The metal has surged nearly 50% year-to-date, putting 2025 on track to become its most impressive showing since 1979 — a year that capped one of the most explosive decades in gold’s history. Back then, the metal rocketed almost 2,300% in ten years, fueled by runaway inflation, oil shocks, and collapsing trust in paper money.

In 2025, there’s no shortage of explanations for gold’s monumental rise — from ballooning sovereign debt and relentless central bank buying, to mounting fears of currency debasement and a slow but steady drift away from U.S. hegemony. Yet, over the past five months, many of those flashpoints have — for now, at least — begun to fade. Inflation has cooled. Trade tensions have eased. Even the geopolitical hotspots that dominated headlines earlier in the year have gone quiet in recent weeks.

And still, gold keeps climbing — defying every traditional narrative and leaving even seasoned observers asking what unseen force is propelling it higher. At the start of the year, it looked like gold might follow its usual pattern and correct sharply after such a dramatic run. Historically, a 50% retracement is both normal and healthy after a surge of this size. But the correction has yet to come — instead, gold simply consolidated for a few months, quietly digesting gains before resuming its climb.

Meanwhile, the financial media began to shift gears. The tone around gold softened — not necessarily positive, but less dismissive. Gold was being discussed again. So were topics once considered fringe: financial resets, monetary realignment, even the decline of the dollar. These ideas were appearing in outlets like the Financial Times — articles that, in years past, would have been spiked long before publication. It felt as though a narrative was being seeded — one that a handful of us had been exploring for years, and often ridiculed for doing so.

When it comes to gold coverage, I’ve noticed a distinct pattern. The media oscillate between cautious praise and sudden derision — celebrating gold’s “strength” one week, mocking “gold bugs” the next. At first glance, it seems inconsistent. But the more I’ve watched it, the more deliberate it appears. It’s as if the media operate a kind of narrative throttle — an accelerator pedal for public sentiment. They talk about gold just enough to avoid suspicion when prices surge, but once interest starts running too hot, they slam the brakes with a wave of derisory press. Some curiosity is allowed; too much could be dangerous. After all, a true rush into gold by ordinary people would rattle the very foundations of the financial system — hastening its unraveling ahead of schedule.

I know that sounds conspiratorial — and it is, deliberately so. Because for the past fifty years, there has been an open, coordinated war on gold: on its price, on its legitimacy, and on how the public perceives it. Yet those mechanisms — the narrative control, the market suppression, the engineered skepticism — now appear to be breaking down. That shift is enormous. And it demands our attention. I have plenty of theories as to why this is, which I have discussed in past articles. But one theory that deserves attention was raised to me just today by my friend Matt Smith from Doug Casey’s Take. Matt has a rare ability to zoom out and see the larger structure — especially how gold fits into the ongoing global financial reset. We often reach similar conclusions from different directions, and this was no exception.

Matt suggested that gold’s rise might not be antithetical to the ambitions of the financial planners. Rather, it could be intentionally allowed — perhaps even through a tacit collective agreement — to climb. His view being that gold will act as a kind of liquidity sink, a mechanism for debt reconciliation, when the next phase of the reset begins. I think Matt is definitely onto something, and that observation immediately took me back to earlier work I’d conducted on the coming reset, particularly work from 2024, when I began noticing a curious pattern among European central banks.

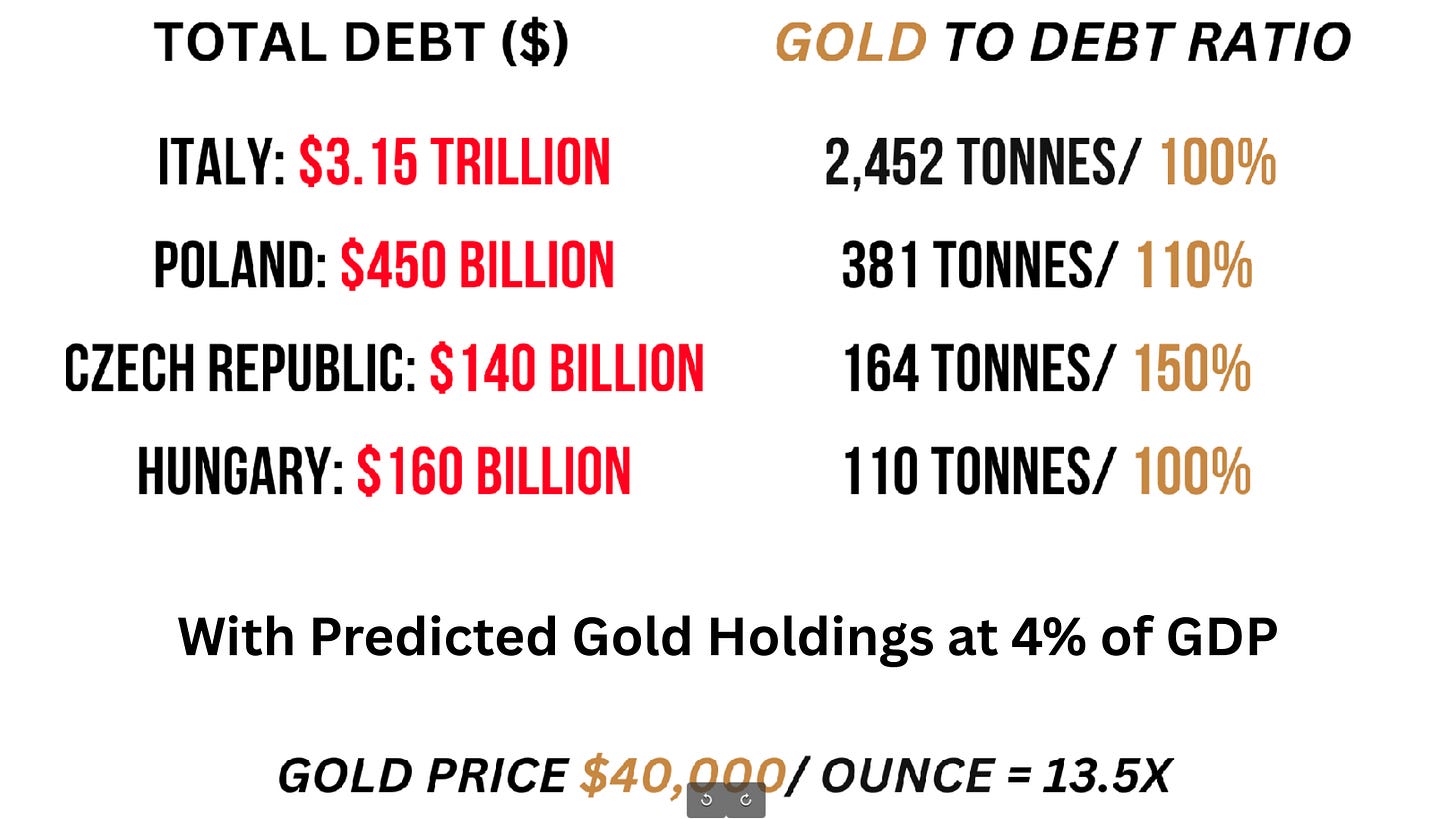

Many were increasing their gold reserves — not arbitrarily, but seemingly in line with their GDP. It wasn’t about tonnage; it was about proportion. Each appeared to be targeting roughly 4% of GDP in gold reserves — suggesting a coordinated framework, possibly in preparation for a future monetary revaluation. By aligning gold reserves to 4% of GDP, central banks effectively calibrate their balance sheets for a post-fiat valuation framework — one where gold again functions as a reserve asset underpinning credit expansion.

This was first highlighted in the work of gold analyst Jan Nieuwenhuijs, who in a 2020 essay titled “European Central Banks Are Ready for a Financial Reset” wrote:

“It’s no coincidence that the ECB and major European central banks are retaining and adding to their gold reserves. They understand gold will be a key asset in the next global monetary system.”

He also noted that nations like the Netherlands, Germany, and Austria had repatriated their gold — a move that only makes sense if they expect it to play a central role in the monetary architecture to come. Then, in 2023, Jan followed up with another piece — “Dutch Central Bank Admits It Has Prepared for a New Gold Standard” — citing comments from Arendt Houben of the Dutch National Bank (DNB). Jan reported:

“In a recent interview, the Dutch central bank (DNB) shared that it has equalized its gold reserves, relative to GDP, with other countries in the eurozone and beyond. This was a political decision. If a financial crisis occurs, the gold price will skyrocket, and official gold reserves can be used to underpin a new gold standard. These statements confirm what I have been writing for years about central banks preparing for a new international gold standard.”

This was nothing short of astonishing in terms of what was admitted. But remember, the comment wasn’t intended for an international audience. It was let slip during a podcast interview conducted in dutch. So only a native speaker with deep knowledge of gold, financial resets, central banking, and monetary history could fully grasp its implications. Fortunately for us, Jan was there to share it. Then, in 2024, I uncovered something that tied it all together. Like Jan’s findings, it was buried in a native-language publication, this time from the Polish National Bank, written by Konrad Raczkowski. That it appeared in the bank’s own publication meant it had been vetted internally, signaling its credibility — and making the revelation all the more extraordinary.

Raczkowski’s background made the discovery even more striking. A former Deputy Minister of Finance, he had been dismissed years earlier for speaking too bluntly about instability within Poland’s banking sector — a man known for saying the quiet part out loud. And once again, he appears to have done exactly that, revealing Europe’s quiet, coordinated accumulation of gold ahead of what increasingly looks like a planned monetary reset:

“As recently as 2017, Polish gold reserves amounted to only 100 tons, accounting for only 1% of GDP. Today it is more than 3% of Polish GDP. The National Bank of Poland has made reasonable decisions to significantly increase gold reserves. In the future, with favorable market conditions, it should buy another about 120 metric tons of gold. Such a level would correspond to the value of reserve assets of this bullion as 4% of GDP, a level analogous to that of the Eurozone. This appears to be the new gold standard for the entire eurozone in the near future. These reserves will have to be matched to the size of the economy.”

For me, this was another bombshell disclosure. Once again, a central bank had openly confirmed what I’d long suspected — that a reset against gold wasn’t just possible, but was already being prepared behind closed doors. I shared the translated article with Jan, who went on to discuss it in his own work. Clearly, our separate discoveries was no mere coincidence. We now had two European central banks openly admitting they were deliberately accumulating gold to a targeted percentage of GDP, ready for some “future event.” Something that the president of the Polish Central Bank Adam Glapinski was even bold enough to speculate on. Now listen to this!

“Gold will retain its value even when someone cuts off the power to the global financial system, destroying traditional assets based on electronic accounting records. Of course, we do not assume that this will happen. But as the saying goes – forewarned is always insured. And the central bank is required to be prepared for even the most unfavorable circumstances. That is why we see a special place for gold in our foreign exchange management process.”

So it seems likely that yes, behind the scenes, at least some central banks are coordinating preparations for a potential reset of the financial system against gold. It echoes the 1970s, when non-US central banks rushed to rebuild their gold holdings after the collapse of Bretton Woods, anticipating a return to a gold-backed system. Their actions were prescient; a return to gold looked inevitable — but that system never materialized. The United States successfully derailed it through the creation of the petrodollar, forcing nations to hold U.S. debt instead of gold — not as a proxy for sound money, but as a means to purchase oil and other critical commodities. It was a masterstroke that extended dollar dominance for half a century. This time, however, there will be no such reprieve. The flood of capital leaving treasuries and flowing into gold will only accelerate from here.

Debt has ballooned to unsustainable levels, hollowing out the system from top to bottom. Meanwhile, the U.S. has no way of stopping the de-dollarization trend — that ship sailed long ago. At the same time, central banks across the West appear to be executing a shared blueprint, aligning their gold reserves to roughly 4% of GDP. To me, there is only one possible conclusion: a gold revaluation is being prepared for. Or, more accurately, it’s already underway. Gold’s 50% surge this year is no accident. While much of the financial media feigns confusion, a few of us have seen this coming for years.

Notably, at just 4% of GDP, most nations could essentially write off their debt if gold reached $40,000 per ounce — only a few percent away from its inflation-adjusted all-time high in 1980. So, is it really that absurd to think they might let the price run higher again, in order to save their skins?

This isn’t just a Western story. China has unofficially accumulated an estimated 30,000–40,000 tonnes of gold. And in preparation for what? For the end of the dollar. But this preparation is also a weapon — one designed to pull the global monetary system back toward gold by default. Every dollar’s decline now strengthens Beijing’s hand. In my 2024 article China’s Hidden War Chest Exposed, I detailed how China’s gold holdings — an Everest compared to all other nations — represent a strategic threat to the United States in ways most analysts still fail to grasp.

For every $100 increase in the gold price, China’s unofficial gold holdings — which should rightly be viewed as part of their foreign-exchange reserves — rise by roughly $90 billion in dollar terms.

I called this the “Chinese finger trap” dynamic — the harder Washington pulls, the tighter it gets. Whilst every dollar Beijing holds becomes less valuable as Washington prints more, every ounce of gold becomes more valuable — that’s the trap. The more the U.S. debases its currency, the wealthier China becomes. Their gold stockpile isn’t just insurance; it’s a mathematical weapon pointed directly at the dollar.

To highlight the point: with gold up roughly 50% in 2025, China has effectively booked over $1 trillion in unrealized gains this year alone! Similarly, their citizens, many still reeling from the collapse of the property market, are now being cushioned by the rising gold price as a result of the government’s long-standing push to redirect household savings into gold. So make no mistake, a rising gold price is welcomed by China. Especially in 2025.

Europe, too, has positioned itself. The continent’s heavyweights — Germany, Italy, and France — already hold thousands of tonnes of gold, with the euro area collectively holding over 10,000 tonnes — second only to the United States. Meanwhile, Eastern European nations like Poland, Hungary, and the Czech Republic — each of which has increased its holdings more than fivefold in recent years — are reaping the same windfall from the current surge in price. This is the quiet power of the “4% of GDP” rule now playing out across the Western world.

So what about the other key player — the United States? Surely they wouldn’t welcome this? As issuer of the global reserve, the dollar has long underpinned U.S. hegemony, financing deficits, enforcing sanctions, and sustaining dominance. But the reality is that Washington knows the dollar’s supremacy is ending. The confiscation of Russian reserves was the final straw for many nations. From that moment, America had no choice but to adapt to the inevitable — and that path leads through a weaker dollar.

That doesn’t mean the U.S. has surrendered its ambitions of hegemony. What we are witnessing under Trump 2.0 is Washington’s forceful response to the end of the petrodollar — a recalibration of power rather than a retreat. While a weaker dollar inherently means a higher gold price, the U.S. has paired this reality with a global trade war designed to extract concessions from rivals and consolidate influence over its allies. As Scott Bessent, former Soros lieutenant and the man charged with managing the Treasury, put it recently, “We want a weaker dollar to allow for a global re-calibration of trade balances.” In other words, the U.S. is deliberately allowing — even encouraging — higher gold prices as part of this transition.

Would America have preferred another path? Absolutely. Gold has no counterparty risk, while the U.S. dollar guaranteed every nation—big or small—had one in Washington. But after decades of systemic abuse and monetary excess, that era is coming to an end. The system needs a reset, and the only asset every major nation can agree on, and trust as a neutral anchor, is gold. When America came out and acknowledged that the dollar was heading lower, it was not only a clear signal that gold was headed much higher, but also that they were on-board with it. Matt did a great job connecting the dots on this in his interview with Mike Fariss on the Coffee and a Mike podcast—one that’s still worth revisiting if you missed it.

I believe this turn-about-face was the explanation for the 2,000 tonnes of gold that then drained out of London and reappeared in the United States. Something I discussed in my February audio newsletter titled ‘Gold, Revaluation & The Sovereign Wealth Funds Hidden Objective’. Officially, this was attributed to tariff adjustments, but both Matt and I saw it differently. It looked like strategic accumulation by somebody with very deep pockets. Another clear sign that the U.S. was serious about a managed devaluation of the dollar vs gold. Which is exactly what has since unfolded. I believe much of that gold remains under the U.S. Treasury’s control. Time will tell, but the evidence points to foresight, not coincidence.

So, to return to Matt’s idea: Are China, the United States, and Europe all quietly aligned in welcoming gold’s rapid rise? I think the answer is likely yes. Whether this alignment is the result of a secret pact behind the scenes, we don’t know. What is clear is that, for now, it serves all three power blocs. The worlds three largest economies now have a vested interest in a higher gold price — and by “higher,” I mean dramatically higher. With all the other structural drivers in place, the brakes could now be off when it comes to price, because only through such a revaluation can global debts ever be reduced to manageable levels. My best guess is that when the time is right, it will pave the way for Bretton Woods 2.0 — not a rigid peg, but a gold-referenced hybrid reserve framework. In this system, the rules will be rewritten, and gold will be officially revalued. Or more accurately, all other assets will be devalued, likely 90–95%, relative to gold, in whatever currencies replace the old ones.

Until then, gold will likely keep rising—creating the fiscal space needed to sustain a debt-saturated system. At some point, though, the runway ends, and phase two of the reset begins. Back in February, Matt and I foresaw how with America on board, the pace of gold’s climb would likely start to quicken. Which brings us full circle: gold is up 50% this year. It’s rewarding to see these ideas play out, but more than anything, it reinforces my confidence that my understanding of the monetary reset—and what comes next—is broadly on the right path. At least enough to make some logical assumptions about how this story will end.

But make no mistake — there is no plan for you to be part of this revaluation process. For obvious reasons, public awareness of gold’s role in the coming reset must remain tightly controlled. If tomorrow every household allocated even 4% of its net worth to gold — as European central banks are now doing — the reset would ignite prematurely, collapsing the old system overnight. That’s why the financial media remain indispensable: to shape perception and manage capital flows. Bitcoin, in this sense, functions as a liquidity sponge for the capital of the little guy — a sanctioned outlet to absorb public demand for hard assets without disturbing gold’s strategic ascent. My belief is that it will be used to trap as many people as possible in the implosion of the old system when it is brought down.

In closing, understand this: gold’s breakout is only Stage One — the prelude. It will continue until the lights go out on the existing order — until the system itself is deliberately imploded. For those who missed it, I went into detail as to how I forsee the revaluations working in my recent piece ‘The Relentless Revaluation of Gold’. In this regard, gold’s rapid rise should be seen as the lighting of the fuse; what follows is the detonation that brings down the buildings. Whether the trigger is a cyber crisis as the Polish Central Banker insinuated, a global conflict, hyperinflation, or all of the above, the mechanism is already armed. Stage Two will emerge in the ashes of that financial cataclysm and it will be the unveiling of a new financial architecture — built around blockchain and digital currencies, with gold restored at its core as the international monetary anchor for settling contracts. As such, every asset, every liability, every illusion of value will have to be revalued against it — forcing a reckoning with decades of debt, debasement, and deceit.

Only those who hold enough gold going into the reset will likely survive what comes next. And to those ends, it’s clear the reset is beyond theory — we’re living it. As my article has hopefully shown, many of my past ideas and theories, along with those of other leading thinkers like Matt, are now linking together to form a somewhat coherent picture as to how this will unfold. If I was wrong, I’d be the first to admit it, but bear in mind that when I first started publishing my ideas, gold was under $2,000 per ounce, and the notion of a reset was considered tin-foil hat territory. Fast forward just a few years, and these ideas are coming to life and there are now few people who would dispute that we are witnessing is the collapse of the post–World War II order. And as this curtain falls, only one question remains: who will control the system that replaces it? If history is any guide, conflict will only intensify from here — until a new consensus is finally forced into being.