Why I First Bought Silver at $14 — and What I think About It At $80

Ten Years After My First Purchase of Silver, I Reflect on the Current Trajectory of the Metal

Ten years ago I bought silver for the first time at $14 oz. It wasn’t just my first purchase of silver — it was also my first real investment. At the time, I didn’t realize it, but that decision would end up reshaping my entire life. Not because silver immediately made me money — it didn’t — but because buying that first ounce marked the moment I stopped believing the system would work for me, and started acting on the understanding that it wouldn’t.

My wife and I were still fairly new in our relationship at the time and had a small pot of savings between us. Prior to 2015, I knew very little about finance, markets, or metals. What I did know was that something wasn’t adding up. We were both well into our respective careers, yet barely getting by. The future we were being offered looked pretty bleak: decades of debt, a mediocre house we’d spend forty years paying off, and no realistic path to real independence.

I decided that was a bad deal.

So I told my wife I was going to figure it out. I knew it would require a radical change, but I also knew that if we were willing to make some big sacrifices there and then, I could learn how money actually worked — how to invest, and how to build real wealth. And then I’d be able to turn our ambitions into reality.

For us, that meant escaping the city, owning a farm and living off the land. Something I thought was going to be necessary given the trajectory of Western civilization. It seemed like an impossible goal for us back then. And yet I promised her within five years we’d make it happen. An ambitious goal for someone with less than $5,000 in the bank, who had spent his entire adult life living paycheque to paycheque.

But I was prepared to go all-in on the idea. I always have been. If there is something I want to achieve in life, I don’t debate with myself over whether I can achieve it. I simply ask what I will need to sacrifice in order to make it happen. Once I understand the price of entry, I then decide whether I’m willing to pay it. In this instance, I absolutely was — even if it meant spending every free waking hour on the project.

This required going right back to first principles. Learning how to save. Learning how money is created. Learning why some people seemed to move effortlessly through the system while others — despite doing everything “right” — never escape it. I didn’t have strong financial role models growing up, and no one ever explained how the system actually worked. In hindsight, that ignorance wasn’t accidental.

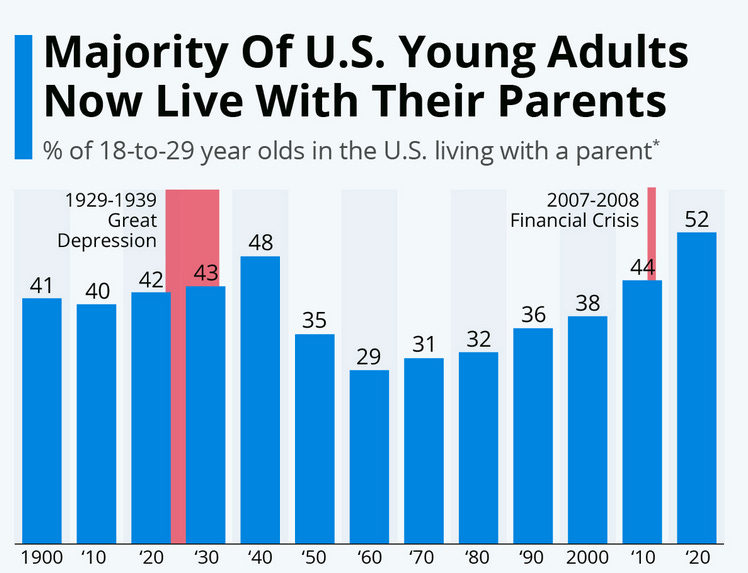

I belonged to the generation that entered the workforce at the worst possible time. I graduated and started looking for work in 2009, at the depths of the GFC. The system was already broken, and the job market reflected it. It took me 4 months just to get hired, and when I finally did, it was for a role several levels below my qualifications. I later learned that more than a hundred people had been shortlisted for the same position. I got the job by the smallest of margins.

But the salary was atrocious. So, to make ends meet, I took on a second job, working late-night shifts managing a team of online counsellors responding to crisis chats from children. It was highly stressful work, with lots of kids disclosing they were about to kill themselves. My job was to guide counselors towards ensuring that didn’t happen.

Whilst I didn’t work every evening, I pulled two to three shifts a week on top of my main job, which was equally stressful. Most weeks I was leaving for work at six in the morning and not getting home until six at night. Then I’d nap, eat some food, head out around 11 p.m., and drive an hour to reach my three-hour night shift. I’d get home around four a.m., sleep for two hours, and do it all again.

In another era, that kind of effort would have produced a comfortable life. But not anymore. I was just getting by — and with no assets to my name, I wasn’t going to benefit from the decade of QE-to-infinity that followed. Instead, I watched house prices and rents spiral out of reach, while wages stagnated. By the time I met my wife, two full-time salaries could barely cover rent and basic bills in the city we lived in.

That was my personal breaking point.

At the time, I didn’t understand how two people — both with Master’s degrees, both working in their chosen professions — were struggling so much. It didn’t take long to identify the cause: inflation, a system designed to trap us in debt slavery, and a ponzi scheme dynamic designed to reward asset owners while quietly hollowing out everyone else. I knew complaining about it wasn’t going to help. So we decided to step outside of the system, literally, and figure it out from the ground up.

That’s where the boat came in.

We had $10,000 between us. That was it. We bought an 8 meter cabin cruiser for around $7,000, leaving $3,000 to invest — along with whatever else we could save. The boat had been built for sea faring, and was completely custom built inside for tiny living.

I ran the numbers and realized that by living on the boat instead of renting an apartment, we could save close to 80% of our income. That margin changed everything. It would give me the space to study, to think, and to begin building a foundation of wealth outside the financial system that had already failed us. So we went all in on our strategy.

Living aboard wasn’t always easy. My wife Moni and I used to joke we didn’t even have a door to slam when we had an argument. Not technically true, we had a swing door between our wheelhouse and our cabin, meaning trying to slam it would simply propel it right back at you. Fortunately, we never found ourselves in that situation!

Rather than seeing it simply as a means to an end, we embraced the whole experience — and came to see it as a blessing. Living on the water, close to nature, was a beautiful lifestyle. We learned to sail, occasionally drunk. It was a lot of fun. A deliberate choice, designed to buy us time and freedom.

So having convinced my then-girlfriend — now wife — that the boat was the answer to our problems, I now had to deliver. In truth, there was no option but to succeed—so I gave it my all.

I spent over 40 hours a week, every week, studying monetary history, finance, commodities, and the markets. From the outset, I was drawn to a classic value-based approach: finding assets that were deeply mispriced, then holding them until the market caught up. Which is why it might sound strange that my first investment wasn’t an actual company, but silver.

The idea was to find something that wasn't a part of the QE doom loop. An asset people had ignored, and left behind. Silver fit the bill perfectly.

Circa 2015 silver wasn’t just cheap — it was hated. The complete opposite of what we are seeing in 2025.

Silvers Low Point

Not everyone reading this will have been investing in silver back then, but at the time both metals were absolutely loathed. Sentiment had been completely destroyed — even amongst the silver bugs. Outside of a small group of die-hards who had survived watching the silver price collapse from $50 an ounce to $14 in just five years, the market had completely abandoned it. People were now openly predicting $5 silver.

To me, that sounded absurd. And it was.