How the Greater Depression Will Shatter the World Order

Commentary | Paid Subscriber Post

Right now, a silent economic collapse is unfolding across the United States, Europe, and China. This is no ordinary recession—not the kind of cyclical, short-lived dip in growth economists are still debating over. What we’re facing will be far deeper, more structural, and more enduring. To describe it, I’ll borrow a term from Doug Casey—legendary investor and friend of the show—who’s long foreseen this exact moment. He calls it The Greater Depression. The long, grinding come-down from a 50-year binge on debt, delusion, and financial engineering.

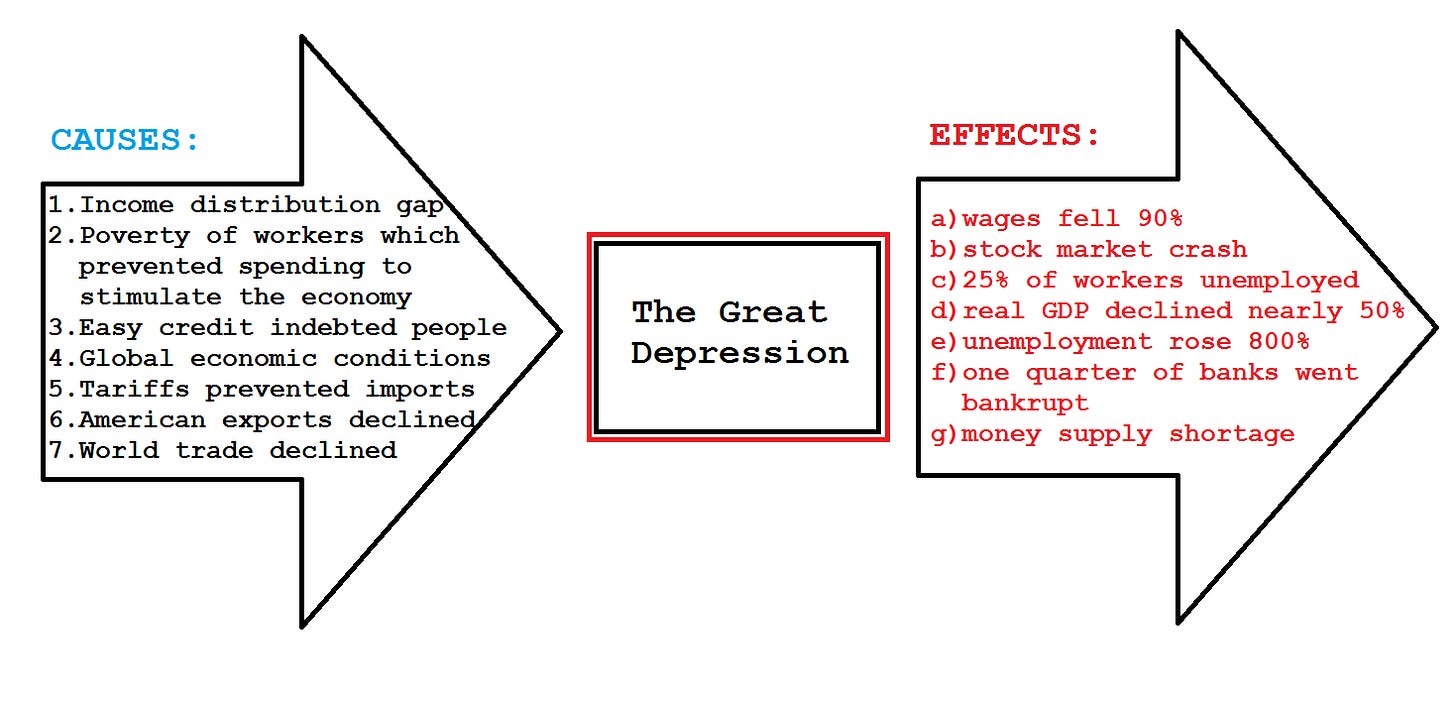

An event so calamitous it will eclipse the Great Depression of 1929–1939 in both depth and duration. In fact, we can already see many similarities between where we are today and the 1930 to 1945 period. Only it's unfolding much more quickly. Perhaps the most obvious parallel is that the Great Depression transpired in the aftermath of the collapse of the largest asset bubble the world had seen up until that point. And what followed was no accident—it was a controlled chain reaction of events designed to reset the system. Financial collapse begot depression, depression begot war, and war cleared the way for a worldwide reset. From which a new world order emerged. Including a new financial paradigm, which today we know as the Bretton Woods system.

To say that history is now rhyming with this period of history would be an understatement, and the reset is happening in much the same way. Take Germany, for example. Just this week, data confirmed that Europe’s largest economy is now in the midst of its longest economic slowdown since the one which occurred following the end of World War II. In large part due to a collapsing industrial sector—20% in energy intensive sectors in just two years. That’s not a historical footnote—it’s happening right now and this catastrophic decline is still underway. Already, the current slowdown ranks as third in line of the longest declines in German history—surpassed only by the Great Depression and the aforementioned post-war collapse.

Of course, the drivers today are different. Germany’s industrial collapse had been fairly stable, before entering freefall following their loss of cheap Russian energy in 2022—thanks in large part to the sabotage of the Nordstream pipeline. The culprit was never officially named, but the fingerprints point clearly to US and allied intelligence. The result? Skyrocketing energy costs and the shuttering or relocation of core German industries. Washington, not coincidentally, now supplies much of Europe with expensive liquefied natural gas—under what can only be described as an energy protection racket. Buy from us, or else.

For Germany, and Europe moreover, this is a catastrophe. And the consequences are about to be realized.

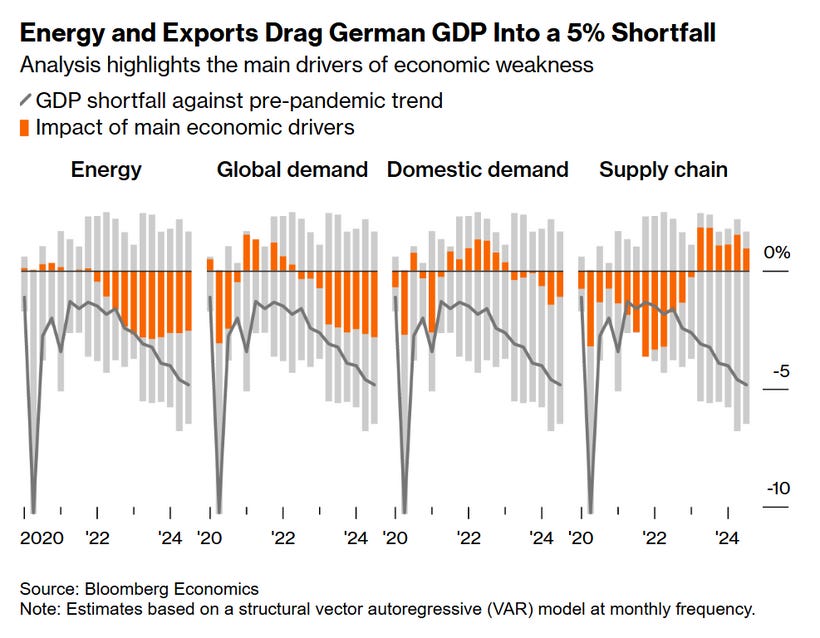

Germany is reaching a point of no return. Business leaders know it, the people in the country feel it, but politicians haven’t come up with answers. That has set Europe’s largest economy on a path of decline that threatens to become irreversible. Following five years of stagnation, Germany’s economy is now 5 per cent smaller than it would have been if the pre-pandemic growth trend had been maintained.

More worryingly, Bloomberg Economics estimates that the bulk of the shortfall will be tough to recover, due to structural blows such as the loss of cheap Russian energy and Volkswagen and Mercedes-Benz Group struggling to keep pace with China’s auto firms. The decline in national competitiveness means every household is worse off by about €2,500 (S$3,700) a year.

“Germany doesn’t collapse overnight. That’s what makes this scenario so absolutely gut-wrenchingly terrifying,” said Ms Amy Webb, founder and chief executive officer of Future Today Institute, which advises German companies on strategy. “It is a very slow, very protracted decline. Not of a company, not of a city, but of the entire country and Europe gets dragged down with it.” - The Straits Times

Reducing Germany’s collapse to energy prices alone is too reductive. There is always a narrative to explain away the rot, but what we’re seeing is a symptom of something bigger. A pervasive breakdown in productive activity and economic cohesion that stretches across continents. And the United States—the world’s largest economy—is a fellow passenger on the same sinking ship.

As of April 2025, the signals are impossible to ignore. The Conference Board’s Leading Economic Index fell another 0.7% in March, extending a steep downward slide. It’s flashing red across every key metric; consumer confidence, manufacturing orders, employment. Gallup now reports that over half of Americans—53%—believe their financial situation is worsening, the worst reading on record. And the data explains why. Household debt is at an all-time high. Delinquencies on credit cards and auto loans are soaring. And the emergency savings that once bridged the gap after the last manufactured crisis? They're long gone.

In this kind of environment, even a routine recession would be enough to push millions of working- and middle-class Americans into full-blown crisis. But what’s emerging is anything but routine. The financial system is buckling under extreme pressure—having been propped up by unsustainable debt levels and inflated valuations on debt-based assets for far too long. But the US backed into a corner. Raise interest rates and the bubbles burst violently. Meanwhile the US is unable to refinance the $7 trillion dollars of debt coming due in the next 12 months. Lower interest rates, and the hyperinflationary endgame suddenly becomes a real possibility. Of course, this is the most likely route; but it will not save the US from the coming depression. What it will do is create an inflationary depression. Given more and more currency will be chasing fewer and fewer goods.