Gold Fires Through $3000 an Ounce - Here's What I Think About It and What Comes Next

Gold | Paid Subscriber Post

Gold hit $3,050 today—another nominal all-time high following its recent breakout above the 3000 level. The last big milestone of $2000 oz was hit just 15 months back, which is kind of crazy when you think about it. The rate of change is certainly increasing, and breaking the $3,000 oz level is a huge psychological milestone for a lot of people. But if you’ve been following my channel, you might have noticed that I haven’t made any real announcements regarding this one.

The truth? I actually forgot I was supposed to be excited. It wasn’t until I saw others celebrating and commenting on the $3000 level that I remembered—oh yeah, this is a big moment for those of us who have entrusted their wealth to gold! And so if you’re one of them, you absolutely should feel good about it. You’ve placed your trust in something real, something that has stood the test of time, and it’s paying off.

The reason this moment doesn’t feel particularly exciting to me, isn’t because it’s unimportant—it’s just that I was so absolutely certain it would happen. Reaching this point feels more like a natural, almost mundane event. It's what happens when you understand something so well, that when it does what few others anticipated, you simply think, "Of course, how could it not have?" Hitting $1,600… then $2,000… then $3,000… was never a question of if for me—only when.

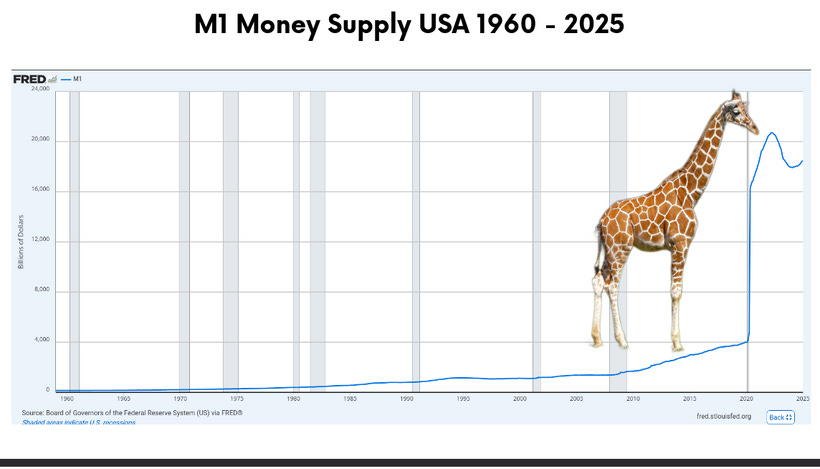

And I can say with complete confidence that this is just the beginning. We’ll see $5,000, then $10,000, and beyond. Furthermore, whilst the price jumps are going to be greater, the time between these key milestones will only get shorter. How do I know all of this? Simply put, as long as fiat currency exists, gold will continue to rise. And the longer a system of currency debasement continues, the faster this will happen.

It’s both a mathematical and historical inevitability. A dynamic which arises from the fact that gold is money. Even today, when they claim otherwise, it acts as such. Meaning that when they devalue fiat currencies, gold is bound to rise. When you realize this, then you quite literally can see the future, when it comes to gold. Despite this, many people, including many analysts in the gold and silver space, still mistakenly view gold as an investment or a commodity, something to trade like stocks or bonds. Which is the wrong approach to take. The financial media are particularly eager to push these narratives, and with good reason!

Ultimately, these narratives speak to a form of conditioning we have all undergone, designed to make gold appear chaotic and risky, with no real function beyond jewellery and hoarding. As though it’s in a similar league to commodities like cocoa beans or copper...only far less useful. This is a powerful lie, but one we are all given from a very young age to ensure we fall for the fiat deception. The matrix, if I may be so bold. It is because of this conditioning, that new gold buyers often experience irrational anxiety about where the gold price is heading. Will it go up? Will it go down? Is it too expensive right now?

I’ll never forget my first gold purchase and the back and forth struggle I had over whether or not the price was too high. It was about a decade ago, and gold was close to $1,100 an ounce. I had done plenty of research by this point and was convinced I understood gold, yet I kept hesitating. Which in hindsight shows I knew far less than I thought. The idea of spending that much money on a single gold coin felt like a huge decision. Up until that point, I had only bought silver—$1,100 could have gotten me well over 50 silver coins. Somehow, holding all that value in one coin, however, felt especially risky.

So I kept putting off the decision—days turned into weeks. Looking back, I probably should have started with a smaller gold coin—a quarter-ounce, a sovereign—but for some reason, I had convinced myself that my first purchase had to be a full ounce or nothing at all. Maybe I wanted it to be something special, in the hope I could hold onto it forever, a piece of wealth I’d never need to sell. But in hindsight, that was the wrong mindset. If you’re in a similar position, debating your first gold purchase, don’t overthink the size. Whether it’s a single gram, a half-ounce, or a full ounce, the most important thing is understanding why you’re buying gold in the first place—then making sure you get it from a reputable dealer.

As fate would have it, just as I was wrestling with this decision, I got a powerful reminder of exactly why gold matters. That summer, I traveled to Poland to visit my in-laws. One night, I sat down with my father-in-law, and we talked about his experience living through hyperinflation in the 1980s and early ’90s. He told me how at first, the collapse of Poland’s currency was slow—prices crept higher, wages stayed the same, and savings quietly lost their value. People were struggling already, given Soviet Communism had reset everyone back to zero. Those who had wealth prior to occupation were either killed or looted, sometimes both.