Are They Going To Use Seized Russian Assets to Trigger the Great Taking?

Europe Is Preparing To Turn Russian Assets Into Ukrainian Debt, And Global Crisis

This week, I uncovered something extremely alarming — a direct link between the Great Taking and the freezing of Russia’s assets. Most people are already aware that hundreds of billions of dollars in Russian reserves were immobilized after the 2022 invasion of Ukraine. What has not been understood, until now, is the deeper significance of how that freeze was possible — and the grave danger embedded in Europe’s plan to now use those very same reserves as collateral for a massive loan package to Ukraine.

Once pledged, the assets shift from “frozen” to effectively confiscated — a transformation with implications that reach far beyond Russia. It’s entirely possible that this single step becomes the spark that triggers a major systemic unwind…or the Great Taking mechanism in full, which I have been discussing with you all recently. Worryingly, the people driving this policy appear to understand exactly what such a decision would unleash.

To understand what is taking place, we first need to understand the structural weakness that allowed the West to seize Russia’s assets in the first place. The critical factor wasn’t sanctions — it was custody. The bulk of Russia’s securities were held at Euroclear, the EU’s Central Securities Depository (CSD). Meaning the assets existed only as dematerialized entries on a digital ledger, registered in what is called street name — which, for those who are not aware, means the ownership of the assets was held by the CSD itself, not the Russian state!

In practical terms, Russia never possessed full legal ownership over these foreign reserves to begin with. They possessed a claim to them. What is called a security entitlement — the same fragile arrangement that governs the ownership of assets held by pension funds, institutions, and everyday investors across the West. This is the core vulnerability at the heart of the Great Taking that David laid bare in his book. What we are seeing now is that mechanism operating in real time — against Russia and its citizens. Whilst the initial freeze shocked many and spurred a rush into gold across the board, the significance runs far deeper.

But it was only whilst studying Europe’s plan to use these reserves as collateral earlier this week that I finally understood the true nature of what is unfolding. The narrative surrounding this plan — Russia vs Ukraine, the West vs the East — is merely the pretext: the potential gateway to a much more broad based asset confiscation and a controlled demolition of the financial system. One that will ripple through the entire financial system, risking a systemic crisis that hits stock markets, commercial banks, CSDs, pension funds, and more — meaning it could be the intended trigger for the Great Taking itself.

In the following article, I’m going to share my findings on this — which up until now nobody has connected the dots on. Even David Rogers Webb, author of The Great Taking, had not made this specific connection between Russia’s asset confiscation and the Great Taking. But once I sent him my notes, he grasped its implications immediately. He told me he believes that if Europe moves ahead with their plan, it could set in motion a chain of events capable of imploding the financial system.

Even the custodian itself, Euroclear, is warning that the use of Russian assets to backstop loans could destabilize the eurozone’s entire financial architecture. Yet in less than a week, Europe looks likely to press ahead regardless. If someone wanted to trigger a major worldwide financial crisis — in a way that could be blamed on Russia and used as cover for a far broader systemic reset — this is exactly how they would do it. Knowing this, is extremely worrying.

For these reasons, I think this is the most important story in finance not being discussed right now.

So let’s get into it.

The Illusion of Ownership

Before explaining what is taking place, here’s a quick recap of how stocks and bonds are actually held. Whenever an individual, an investment firm, an insurer, or a pension fund buys a security, they do not receive true ownership. They receive what is called a security entitlement — a claim on the asset, not the asset itself. The real legal title is held by the Central Securities Depository (CSD). The asset is registered in the CSDs name, or in the name of a dummy corporation it controls (“street name”), with the physical certificate locked in its vault. This is how all modern securities are structured.

Behind the scenes, every one of these holdings — millions upon millions — is merged into a single, undivided pool controlled entirely by the CSD. There is no segregation; everything is co-mingled. This entire pool is then pledged as collateral for the mega-banks’ $2–4 quadrillion derivatives exposure. If you’re not familiar with this, you need to read David’s book — but here is the simplest way to understand it:

Imagine you buy an expensive painting. You pay full price, receive paperwork stating it’s yours, and you’re told you’re the rightful owner. But the painting never leaves the gallery. It stays on their wall, under their lock and key, in a room filled with thousands of other privately “owned” works. You can visit it and point at it proudly — but you can only take home a copy, a sophisticated fake.

You’re told this arrangement is for your safety — until you learn the gallery has pledged your painting, and every other original in the building, as collateral for a sprawling web of high-stakes bets made by powerful patrons behind the scenes. These patrons sit at the top of the hierarchy — a privileged creditor class whose claims outrank everyone else’s, despite the fact they never paid for any of the artwork in the first place.

Their bets exceed the value of the entire collection many times over. So if — or when — those bets go bad and the gallery collapses, the whole collection goes to them. And you have no power to stop it.

At some point, a few owners begin asking questions, shocked to learn this is all perfectly legal — because the lawyers designed the system so that the gallery, not the buyers, holds the real title to every painting. And the final insult comes when you’re told that if the gallery fails, your legal claim isn’t against the gallery at all, but against the taxi company that drove you there — your broker. A party with no access to the paintings and no ability to compensate you.

A security entitlement is exactly this: a legal fiction — ownership in appearance only, stripped of the authority that real ownership requires. “Beneficial ownership” sounds comforting, but in reality it puts you at the bottom of a long chain of intermediaries. When the system comes under stress, you are the one left holding the empty bag.

Meanwhile, the actual assets can be seized, reassigned, or absorbed by those at the very top — the secured creditors — who will walk away with the entire co-mingled asset pool: stocks, bonds, pensions, mortgages, land titles, everything.

In other words…The Great Taking.

The Fight for Russia’s Frozen Assets — and Why It Matters

Now, back to Russia’s frozen assets.

As discussed, a battle is now underway in Europe over control of the assets “frozen” by Euroclear at the direction of Western governments — a retaliatory move against both the Russian state and Russian citizens for the war in Ukraine. The freeze immediately triggered a scramble to convert these immobilized reserves into usable wealth. The United States proposed diverting the assets to fund the “rebuilding of Ukraine,” with 50% of the returns guaranteed to flow to America. European nations, meanwhile, have long pushed to use the assets as collateral for new war loans to Ukraine, since the funds sit inside their own financial system.

For a long time, all of this was being discussed only in the theoretical. That has now changed. In recent months, Europe has signaled a clear intention to move ahead with its plan to fully confiscate and collateralize Russia’s frozen assets — with December 18th emerging as the decisive deadline. This makes the situation urgent, because if they proceed, a domino will be pushed that both David and I fear could trigger a chain reaction the system cannot recover from.

What’s Frozen, and Where?

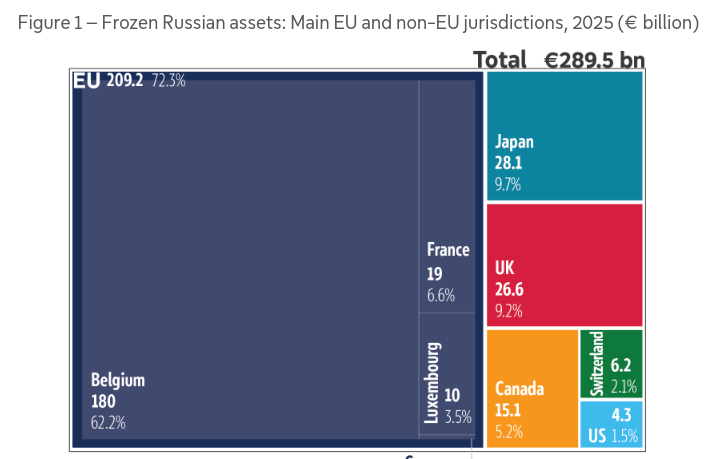

Whilst exact size of Russian assets frozen in the EU is being shrouded in secrecy, some rough estimates are as follows:

At least €300 billion in Russian central-bank reserves were frozen by the G7 + EU after the 2022 invasion.

About €210 billion is immobilised inside the EU, mostly at Euroclear in Belgium.

Another €28 billion in private Russian assets — belonging to oligarchs, companies, and individuals — is frozen across European banks and at Euroclear.

Governments consistently call these assets “immobilized” or “frozen,” not “confiscated.” But the moment they are pledged as collateral, that distinction disappears.

European governments have been evasive about the total value of Russian assets they have frozen. A European Parliament research paper estimated that beyond Belgium’s €210 billion:

France may be holding €19 billion,

Luxembourg between €5–20 billion, (held at their NSD Clearstream)

Japan €28 billion,

UK €26 billion,

Canada €15 billion,

Switzerland €6 billion,

United States around €4 billion.

Taken together, these figures actually exceed the often-cited global total of $300 billion frozen — which is unsurprising. In fact, it may be subterfuge to cover up the scale of the looting they’re going to enact. Some estimates say the real figure is potentially over $1 trillion.

What we do know is that most of Russia’s assets were sovereign bonds, many of which have now reached maturity. This means CSDs like Euroclear were left holding giant piles of cash on behalf of Russia. Given Russia is essentially barred from making decisions around what happens to that capital, Europe has redirected the assets back into bonds — namely, Belgian government debt.

When first immobilised, most of the Russian state assets were debt securities in the form of government bonds, but a large portion – up to 90 % – have matured into cash by now. In the absence of instructions by the lawful owner of the deposits, since the CBR is under sanctions, this cash is held in low-risk accounts. For example, in the case of Euroclear, this cash is, by law, deposited into Belgian central bank investments, which offer the lowest risk-free rate of return available.

A growing number of international legal experts and prominent political figures have defended the lawfulness of confiscating Russian central bank assets to sustain Ukraine, both for financing reconstruction efforts and military expenses, despite those assets being protected by state immunity under international customary law.

— EU Briefing: Confiscation of immobilised Russian sovereign assets

The goal at present is to unfreeze the assets, convert them to cash — not to return it to Russia, but to expropriate it and use it as collateral for loans exceeding €160 billion for Ukraine. Despite the fact that Ukraine has zero justification for continuing the conflict, and it would be throwing good money after bad, European nations appear hell-bent on moving forward with this plan. As does Ukraine, which is cheering on the move at every possible juncture.

All of this is occurring in spite of the fact that behind the scenes, the decision-makers have been made well aware that the fallout of such a move could be catastrophic for the world — potentially triggering a global financial meltdown and escalating the Ukraine–Russia war from a proxy conflict into a full-blown world war. Time is almost up to stop this from occuring.